September 26, 2017

What is NYSE Composite Index?

^NYA, NYSE Composite is a US stock market index covering all common stock listed on the New York Stock Exchange, including such as American depository receipts, real estate investment trusts, tracking stocks, and foreign listings.

^NYA, NYSE Composite over 2,000 stocks are covered in the index, of which over 1,600 are from United States corporations and over 360 are foreign listings.

Somewhat Frustrated

You feel somewhat frustrated as the trend just keep moving higher; if professional trade retracement how to enter.

Despite the world situation, American stocks continue to make higher high, example NYSE Composite Index. Seldom seen so many factors such as negative news and yet from a technical basis set up to see the market to go lower, but week after week the stock market just continue to go higher.

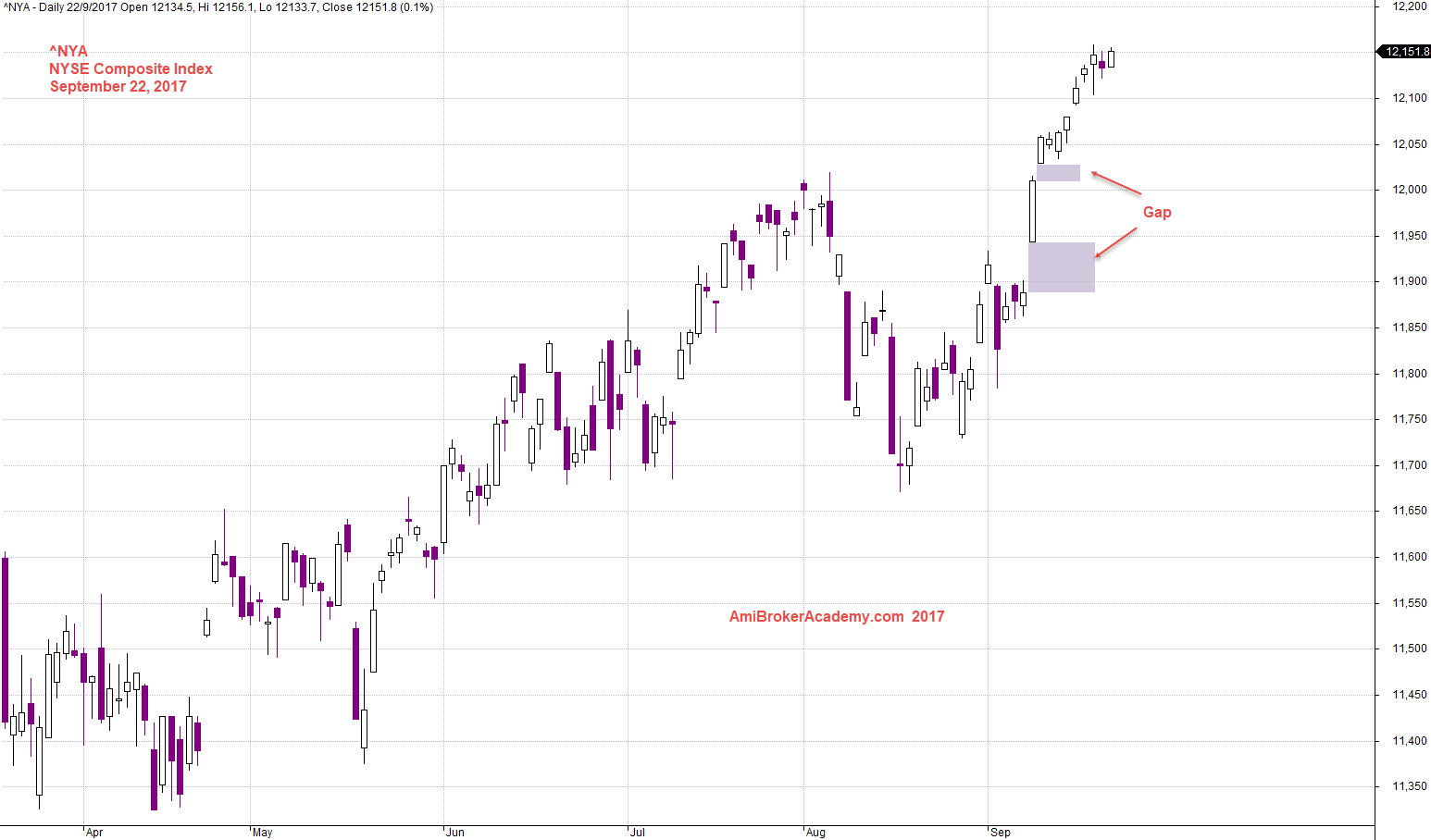

^NYA NYSE Composite Index and Gaps

It’s interesting to note that we’ve had gap ups in the New York Stock Exchange index. This has never seen it happen before but anyone can recall.

September 22, 2017 NYSE Composite Index and Gaps

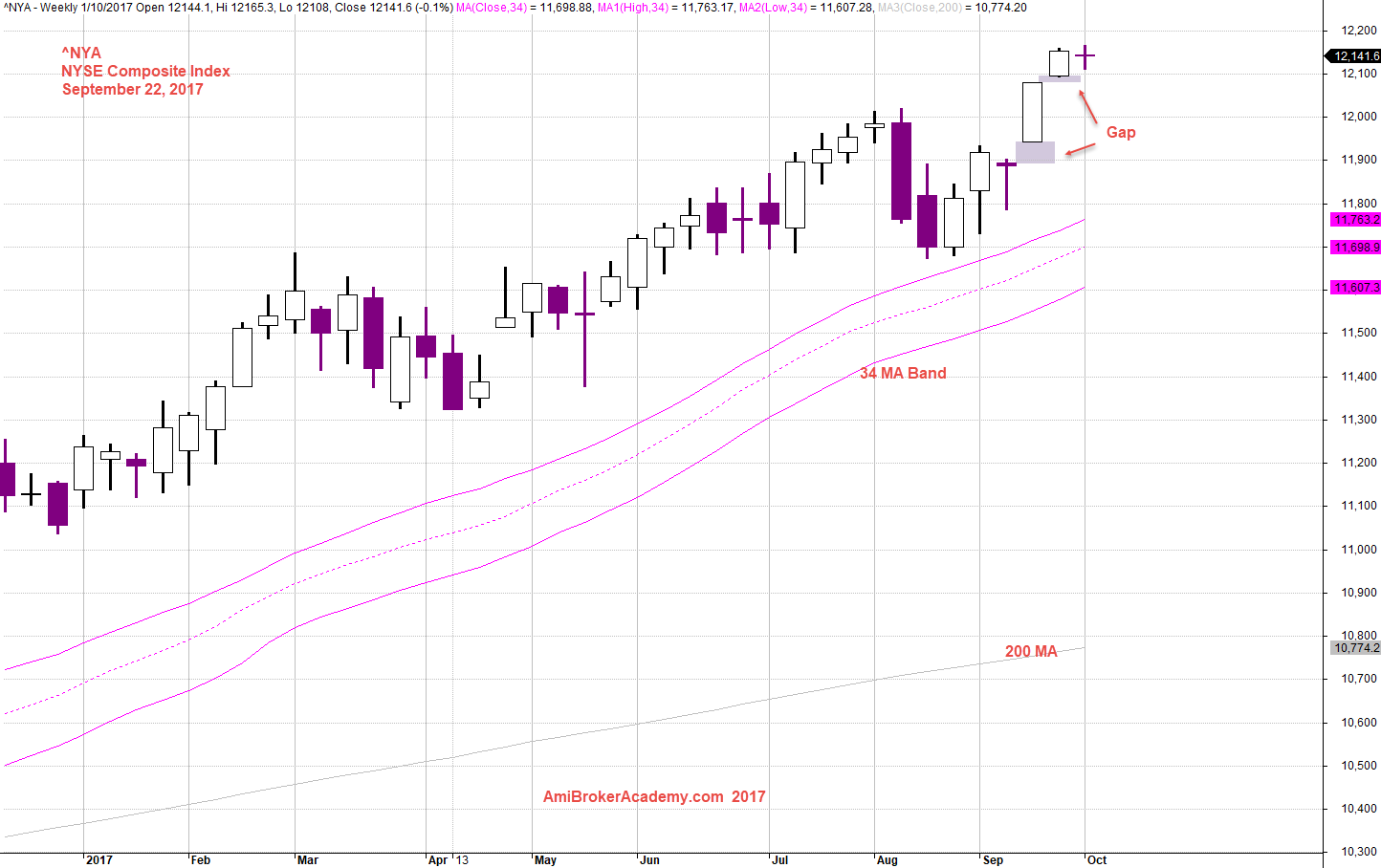

^NYA NYSE Composite Index Weekly and Gaps

To make it easy to read the chart, let examine the weekly chart. These gaps are much easier to spot. See chart for more.

September 22, 2017 NYSE Composite Index Weekly and Gaps

^NYA NYSE Composite Index Weekly and Retracement

Picture worth a thousand words, see chart. Trade retracement.

September 22, 2017 NYSE Composite Index and Retracement

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.