30 June 2021

Welcome!

Welcome to AmiBroker Academy dot com, amibrokeracademy.com.

We will use 1) Ichimoku Cloud, 2) Support Resistance (using box), 3) River (moving average), 4) GMMA and Woodies CCI, 5) Bollinger Bands and Moving Averages, and 6) MACD to analyze crypto currency chart. See our reading of price action.

We translate what the price action tell us, ie Picture worth a thousand words.

1) DOT1 | Polkadot Crypto and Ichimoku Cloud

Ichimoku Cloud is a trend following strategy tool. In 2021 March, we see the Tenkan Sen cross below Kijun Sen and retrace up again. But the bull end in May, and begin to close below cloud. So, Polkadot had topping the high. Will see.

Ichimoku Cloud is a multi-dimensional indicator designed to offer support and resistance levels, trending, and entry and exit points. Price Action after test the high and pullback to close below cloud. Price Action stay below cloud, ie bear trend.

Trade what you see.

Manage risk is a key in trading.

Moses Free Charting

2) Polkadot Crypto and Support Resistance

Price Action goes from low to high, ie price action goes from bottom left to top right. However, the price action fail to go higher in May, from the box, the month high low May is a volatile month. Price Action has dropped from near 50 Dollars to the low of 14 Dollars. Trade with eyes open, and manage your risk.

We use box to box month high low to find a major level. See chart. We have plotted two strong levels, see chart. Can the support hold the fall? Will see.

Trade what you see. Manage your risk.

3) Polkadot Crypto and Rive

Moving Average is a great visual tool. Raghee uses high, low and close 34 EMA to form a band to determine the wave direction. Price action is currently close below 34 EMA and 34 EMA slopping down, bear trend? Trade what you see.

Down trend seems strong, price action close below River. River cross below 200 MA, dead cross.

From a different view, we see price action supported by support.

Manage your risk.

4) Polkadot Crypto and GMMA and Woodies CCI

Price Action crosses down under Slow MA (red), Fast MA (green) has closed under Slow MA (red) too. Price Action is resisted by Fast (green). Can the price action retrace above Slow MA (red) again? Will see. Trade with eyes open.

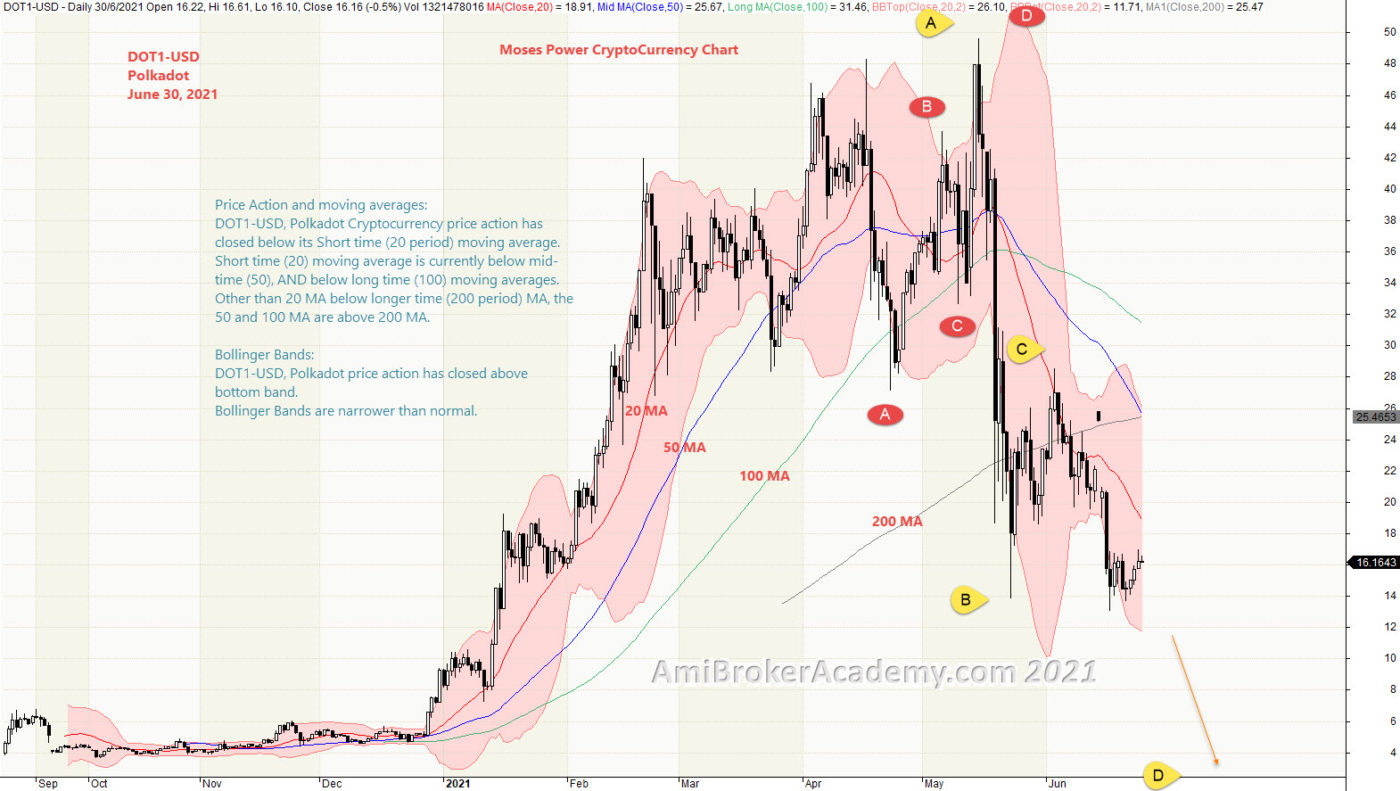

5) Polkadot Crypto and Bollinger Bands and Moving Averages

Price Action and moving averages:

DOT1-USD, Polkadot Cryptocurrency price action has closed below its Short time (20 period) moving average.

Short time (20) moving average is currently below mid-time (50), AND below long time (100) moving averages.

Other than 20 MA below longer time (200 period) MA, the 50 and 100 MA are above 200 MA.

Bollinger Bands:

DOT1-USD, Polkadot price action has closed above bottom band.

Bollinger Bands are narrower than normal.

Manage your risk.

6) Polkadot Crypto and MACD Divergence

We see price action continues to go higher before the price action close below the last low, and suddenly the Polkadot lost the energy to drive price action higher. Remember all these can not come without any early signals. When you look down and left to MACD, you will find MACD forms lower high. MACD Divergence. MACD Divergence has signaled you that the price action is weaken, price action be move south. Of course, just like traffic light, you do not stop at every traffic light, But it is wise to trade with what you see. Manage your risk.

Don’t take MACD Divergence too lightly.

Moses Power Charting

Official AmiBrokerAcademy.com Charting

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.

We learn from many past and present great traders. Kudo to these master.