May 17 2022

Welcome!

Welcome to AmiBroker Academy dot com, amibrokeracademy.com.

If There is Only One Chart This is It

Moses Stock Chart.

Our Believe – Buy Support Sell Resistance.

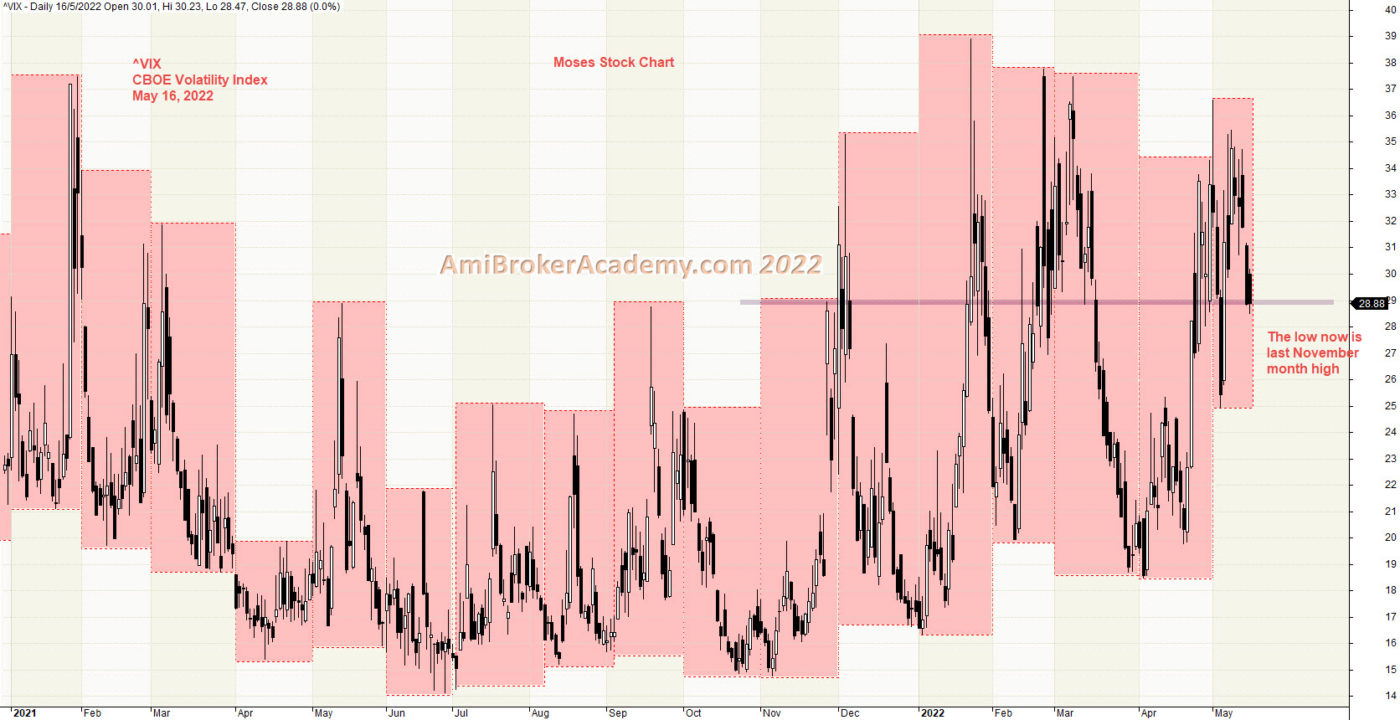

1) CBOE Volatility Index and Month High Low

Price Action reflect the market emotions, it factor in news, buy or sell emotions.

We use box to box the month high low to determine the volatility of the month. The bigger the box the volatile the price action. Price Action pullback to the test the high of last November high.

If you are a buy and hold strategist, Will you sell now or buy now? Remember only buy near support, and sell near resistance. Wait for the price action draw near either resistance or support before action.

Moses Power Charting

Official AmiBrokerAcademy.com Charting

Disclaimer

The above result is for illustration purpose. It is meant to be used for learning buy or sell signals. We do not recommend for any particular stocks. If particular stocks of such are mentioned, they are meant as a demonstration of Amibroker as a powerful charting software. Amibroker is a charting software, it can program to scan the stocks for buy and sell signals. Or backtest for any trading strategy or technique.

We post script generated signals. Not all scan results are shown here depending on selection criterial. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.

We learn from many past and present great traders. Kudo to these master.