August 26, 2017

We had a look at Dunkin Brands Group in the last analysis. See past posting or a snap short below.

August 25, 2017 Dunkin Brands Group Zoom Out and Support Resistance

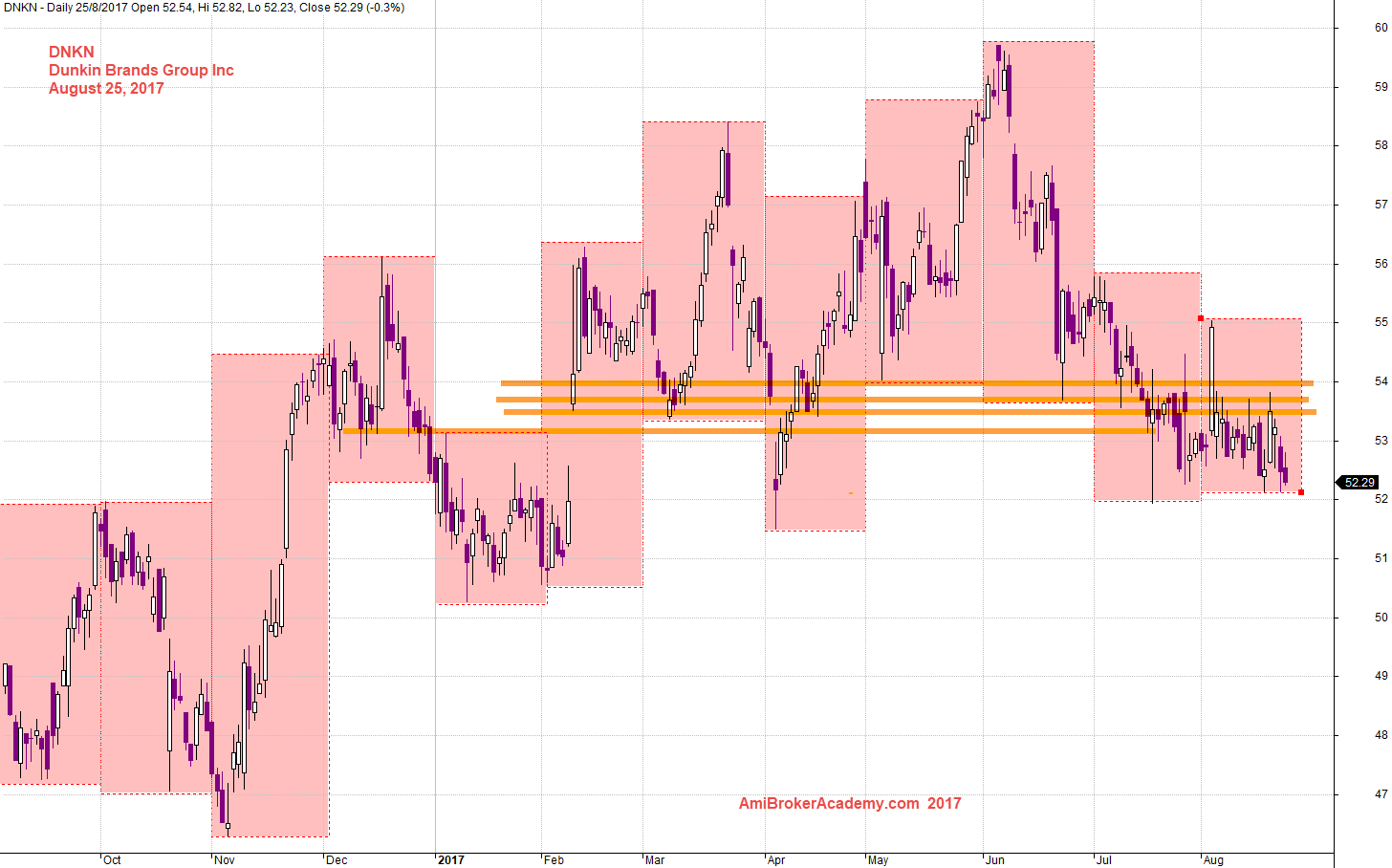

DNKN Dunkin Brands Group and Support Resistance

Picture worth a thousand words. See chart for more. We zoom out, we see resistance turns support. So, random walk no non-random walk there aren’t much to worry about. Have fun!

Be Sure, Trading Is Not As Easy As ABC

Trading isn’t running too smoothly sometime, especially you have reached a critical stage, such as support resistance is suggesting that the breakout or fail could be in the air. If you want to avoid the situation becoming bitter and reaching the point of no return, you need to be more flexible and show some tolerance. In the professional trading, you have a tendency to doubt your own capacities and judgement, under the influence of the previous trend.

It’s just as well that retest of the same level has an appearance, providing you with believe that helps you successfully complete your believe. Do you not find it reassuring to finally see that the price action has been taking so long? The time has drain the energy for breakout below. …

Let’s study more chart to understand the stock Dunkin Brands Group better.

Another View of DNKN Dunkin Brands Group and Support Resistance

Picture worth a thousand words, see chart for more. On one hand, the price action taking too long to breakout below, and on the other hand the price action has been resisted to move up higher. So, wait lah!

August 25, 2017 Dunkin Brands Group and Support Resistance

DNKN Dunkin Brands Group and Channel

Picture worth a thousand words, see chart for more. We see the price action are trapped in the channel. But if we break the channel into layer. We see the price action has broken out the lower of the second channel layer. The price action has breakout further the last layer. See chart for details.

August 25, 2017 Dunkin Brands Group and Channel

DNKN Dunkin Brands Group and MACD

Picture worth a thousand words, see chart for more. The more you look at the chart, the more you can not give up. You will try to find all mean to find the reason for an early entry. We are not suggest you enter any trade. We just want to let you know, professional trader will never just stand aside to watch. They will try all mean to justify a trade. … Risky. Many of the professional trader manage their risk, for trade that they are completely not sure, and yet still want to play. They will go real small, so small until even if they make a wrong analysis. The trade is not going to kill them. However, this is easy say then don.

We suggest, if you can not figure out, stand aside.

Have fun! Enjoy learning. Thanks for being here and read that far.

August 25, 2017 Dunkin Brands Group and MACD Signals

Thanks for visit the site here. You could also find free MACD scan here in this site too.

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.