13 January, 2019

Thanks for visiting the site.

Free U.S. Stock Five-day MACD Scan

Wht is AmiBroker AFL?

See the following link https://www.amibroker.com/guide/AFL.html on AmiBroker AFL.

What is MACD?

MACD stands for Moving Average Convergence Divergence, common setting is (12,26,9)

MACD indicator is a trend trading system that makes up of 2 lines. The MACD Line (fast line) and MACD Signal Line (slow line).

1) When the MACD Line crosses over the MACD Signal Line the trend is bullish. When the MACD Line crosses below the MACD Signal the trend is bearish.

2) When the MACD Line crosses above zero line the trend is bullish. When the MACD line crosses below zero line the trend is bearish.

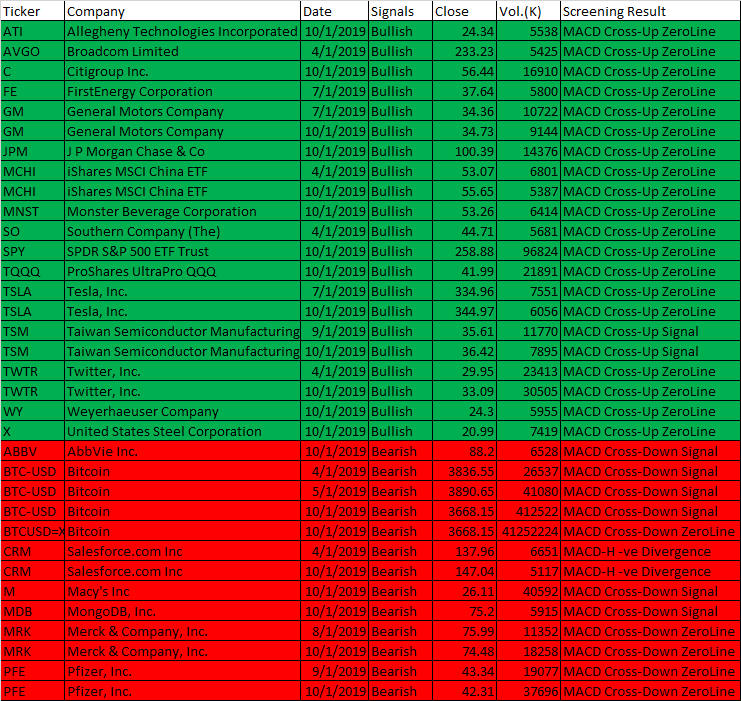

4 to 10 January 2019 AmiBroker AFL Script Generated Five-day U.S. Stock MACD Signals

The following are script generated Five-day U.S. Stock Market MACD signals using the Powerful AmiBroker’s AFL.

The MACD Setting used is (8,17,9)

| Ticker | Company | Date | Signals | Close | Vol.(K) | Screening Result |

| ATI | Allegheny Technologies Incorporated | 10/1/2019 | Bullish | 24.34 | 5538 | MACD Cross-Up ZeroLine |

| AVGO | Broadcom Limited | 4/1/2019 | Bullish | 233.23 | 5425 | MACD Cross-Up ZeroLine |

| C | Citigroup Inc. | 10/1/2019 | Bullish | 56.44 | 16910 | MACD Cross-Up ZeroLine |

| FE | FirstEnergy Corporation | 7/1/2019 | Bullish | 37.64 | 5800 | MACD Cross-Up ZeroLine |

| GM | General Motors Company | 7/1/2019 | Bullish | 34.36 | 10722 | MACD Cross-Up ZeroLine |

| GM | General Motors Company | 10/1/2019 | Bullish | 34.73 | 9144 | MACD Cross-Up ZeroLine |

| JPM | J P Morgan Chase & Co | 10/1/2019 | Bullish | 100.39 | 14376 | MACD Cross-Up ZeroLine |

| MCHI | iShares MSCI China ETF | 4/1/2019 | Bullish | 53.07 | 6801 | MACD Cross-Up ZeroLine |

| MCHI | iShares MSCI China ETF | 10/1/2019 | Bullish | 55.65 | 5387 | MACD Cross-Up ZeroLine |

| MNST | Monster Beverage Corporation | 10/1/2019 | Bullish | 53.26 | 6414 | MACD Cross-Up ZeroLine |

| SO | Southern Company (The) | 4/1/2019 | Bullish | 44.71 | 5681 | MACD Cross-Up ZeroLine |

| SPY | SPDR S&P 500 ETF Trust | 10/1/2019 | Bullish | 258.88 | 96824 | MACD Cross-Up ZeroLine |

| TQQQ | ProShares UltraPro QQQ | 10/1/2019 | Bullish | 41.99 | 21891 | MACD Cross-Up ZeroLine |

| TSLA | Tesla, Inc. | 7/1/2019 | Bullish | 334.96 | 7551 | MACD Cross-Up ZeroLine |

| TSLA | Tesla, Inc. | 10/1/2019 | Bullish | 344.97 | 6056 | MACD Cross-Up ZeroLine |

| TSM | Taiwan Semiconductor Manufacturing Company Ltd. | 9/1/2019 | Bullish | 35.61 | 11770 | MACD Cross-Up Signal |

| TSM | Taiwan Semiconductor Manufacturing Company Ltd. | 10/1/2019 | Bullish | 36.42 | 7895 | MACD Cross-Up Signal |

| TWTR | Twitter, Inc. | 4/1/2019 | Bullish | 29.95 | 23413 | MACD Cross-Up ZeroLine |

| TWTR | Twitter, Inc. | 10/1/2019 | Bullish | 33.09 | 30505 | MACD Cross-Up ZeroLine |

| WY | Weyerhaeuser Company | 10/1/2019 | Bullish | 24.3 | 5955 | MACD Cross-Up ZeroLine |

| X | United States Steel Corporation | 10/1/2019 | Bullish | 20.99 | 7419 | MACD Cross-Up ZeroLine |

| ABBV | AbbVie Inc. | 10/1/2019 | Bearish | 88.2 | 6528 | MACD Cross-Down Signal |

| BTC-USD | Bitcoin | 4/1/2019 | Bearish | 3836.55 | 26537 | MACD Cross-Down Signal |

| BTC-USD | Bitcoin | 5/1/2019 | Bearish | 3890.65 | 41080 | MACD Cross-Down Signal |

| BTC-USD | Bitcoin | 10/1/2019 | Bearish | 3668.15 | 412522 | MACD Cross-Down Signal |

| BTCUSD=X | Bitcoin | 10/1/2019 | Bearish | 3668.15 | 41252224 | MACD Cross-Down ZeroLine |

| CRM | Salesforce.com Inc | 4/1/2019 | Bearish | 137.96 | 6651 | MACD-H -ve Divergence |

| CRM | Salesforce.com Inc | 10/1/2019 | Bearish | 147.04 | 5117 | MACD-H -ve Divergence |

| M | Macy’s Inc | 10/1/2019 | Bearish | 26.11 | 40592 | MACD Cross-Down Signal |

| MDB | MongoDB, Inc. | 10/1/2019 | Bearish | 75.2 | 5915 | MACD Cross-Down Signal |

| MRK | Merck & Company, Inc. | 8/1/2019 | Bearish | 75.99 | 11352 | MACD Cross-Down ZeroLine |

| MRK | Merck & Company, Inc. | 10/1/2019 | Bearish | 74.48 | 18258 | MACD Cross-Down ZeroLine |

| PFE | Pfizer, Inc. | 9/1/2019 | Bearish | 43.34 | 19077 | MACD Cross-Down ZeroLine |

| PFE | Pfizer, Inc. | 10/1/2019 | Bearish | 42.31 | 37696 | MACD Cross-Down ZeroLine |

Moses U.S. Stock MACD Scan

AmiBroker Academy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.