6 May, 2018

Thank you for visiting the site. Hope you like the content.

Russell 2000

The small-cap benchmark index of the bottom 2,000 stocks in the Russell 3000 Index. Manage your risk.

Picture worth a thousand words, see chart for the trend and market.

May 4, 2018 Russell 2000 and MACD

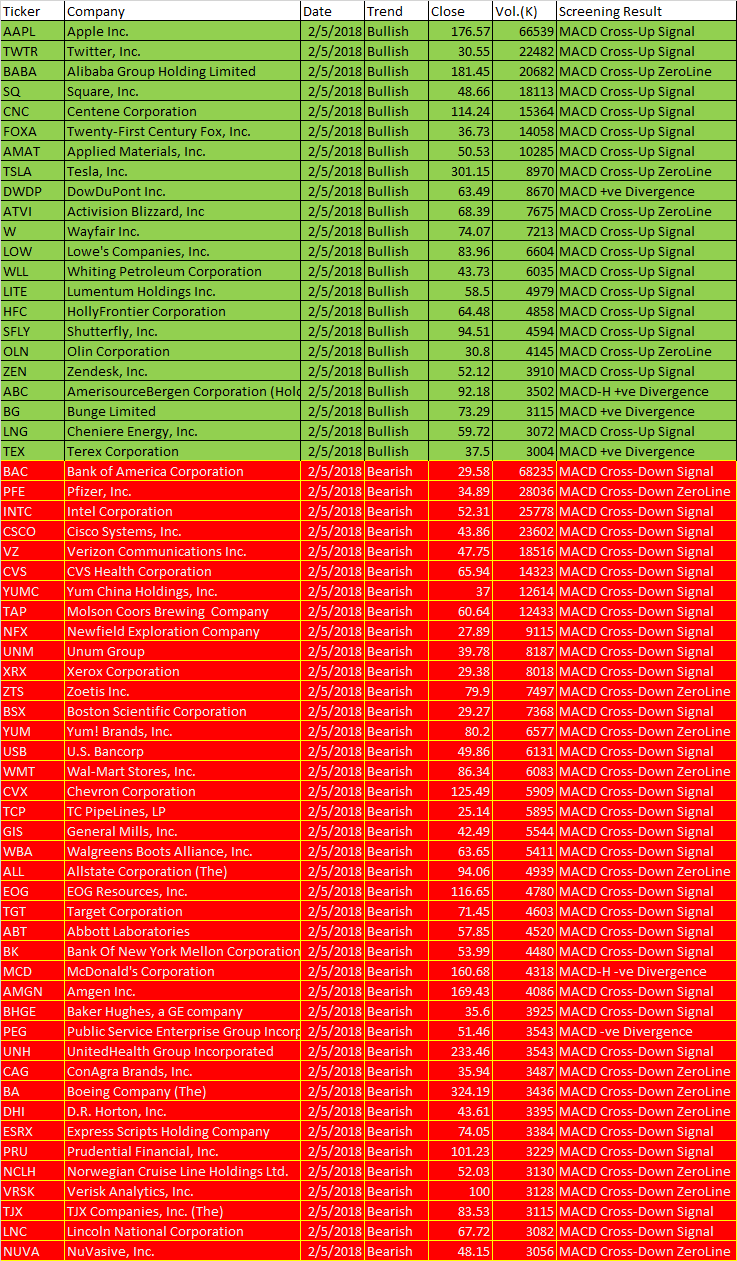

Free MACD Scan One-day US Stock MACD Screening Results on May 2 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup. See some of the MACD setup fail examples on this website.

May 2, 2018 US Stocks One-day MACD Screener Signals

These are the six types of MACD Signals:

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| AAPL | Apple Inc. | 2/5/2018 | Bullish | 176.57 | 66539 | MACD Cross-Up Signal |

| TWTR | Twitter, Inc. | 2/5/2018 | Bullish | 30.55 | 22482 | MACD Cross-Up Signal |

| BABA | Alibaba Group Holding Limited | 2/5/2018 | Bullish | 181.45 | 20682 | MACD Cross-Up ZeroLine |

| SQ | Square, Inc. | 2/5/2018 | Bullish | 48.66 | 18113 | MACD Cross-Up Signal |

| CNC | Centene Corporation | 2/5/2018 | Bullish | 114.24 | 15364 | MACD Cross-Up Signal |

| FOXA | Twenty-First Century Fox, Inc. | 2/5/2018 | Bullish | 36.73 | 14058 | MACD Cross-Up Signal |

| AMAT | Applied Materials, Inc. | 2/5/2018 | Bullish | 50.53 | 10285 | MACD Cross-Up Signal |

| TSLA | Tesla, Inc. | 2/5/2018 | Bullish | 301.15 | 8970 | MACD Cross-Up ZeroLine |

| DWDP | DowDuPont Inc. | 2/5/2018 | Bullish | 63.49 | 8670 | MACD +ve Divergence |

| ATVI | Activision Blizzard, Inc | 2/5/2018 | Bullish | 68.39 | 7675 | MACD Cross-Up ZeroLine |

| W | Wayfair Inc. | 2/5/2018 | Bullish | 74.07 | 7213 | MACD Cross-Up Signal |

| LOW | Lowe’s Companies, Inc. | 2/5/2018 | Bullish | 83.96 | 6604 | MACD Cross-Up Signal |

| WLL | Whiting Petroleum Corporation | 2/5/2018 | Bullish | 43.73 | 6035 | MACD Cross-Up Signal |

| LITE | Lumentum Holdings Inc. | 2/5/2018 | Bullish | 58.5 | 4979 | MACD Cross-Up Signal |

| HFC | HollyFrontier Corporation | 2/5/2018 | Bullish | 64.48 | 4858 | MACD Cross-Up Signal |

| SFLY | Shutterfly, Inc. | 2/5/2018 | Bullish | 94.51 | 4594 | MACD Cross-Up Signal |

| OLN | Olin Corporation | 2/5/2018 | Bullish | 30.8 | 4145 | MACD Cross-Up ZeroLine |

| ZEN | Zendesk, Inc. | 2/5/2018 | Bullish | 52.12 | 3910 | MACD Cross-Up Signal |

| ABC | AmerisourceBergen Corporation (Holding Co) | 2/5/2018 | Bullish | 92.18 | 3502 | MACD-H +ve Divergence |

| BG | Bunge Limited | 2/5/2018 | Bullish | 73.29 | 3115 | MACD +ve Divergence |

| LNG | Cheniere Energy, Inc. | 2/5/2018 | Bullish | 59.72 | 3072 | MACD Cross-Up Signal |

| TEX | Terex Corporation | 2/5/2018 | Bullish | 37.5 | 3004 | MACD +ve Divergence |

| BAC | Bank of America Corporation | 2/5/2018 | Bearish | 29.58 | 68235 | MACD Cross-Down Signal |

| PFE | Pfizer, Inc. | 2/5/2018 | Bearish | 34.89 | 28036 | MACD Cross-Down ZeroLine |

| INTC | Intel Corporation | 2/5/2018 | Bearish | 52.31 | 25778 | MACD Cross-Down Signal |

| CSCO | Cisco Systems, Inc. | 2/5/2018 | Bearish | 43.86 | 23602 | MACD Cross-Down Signal |

| VZ | Verizon Communications Inc. | 2/5/2018 | Bearish | 47.75 | 18516 | MACD Cross-Down Signal |

| CVS | CVS Health Corporation | 2/5/2018 | Bearish | 65.94 | 14323 | MACD Cross-Down Signal |

| YUMC | Yum China Holdings, Inc. | 2/5/2018 | Bearish | 37 | 12614 | MACD Cross-Down Signal |

| TAP | Molson Coors Brewing Company | 2/5/2018 | Bearish | 60.64 | 12433 | MACD Cross-Down Signal |

| NFX | Newfield Exploration Company | 2/5/2018 | Bearish | 27.89 | 9115 | MACD Cross-Down Signal |

| UNM | Unum Group | 2/5/2018 | Bearish | 39.78 | 8187 | MACD Cross-Down Signal |

| XRX | Xerox Corporation | 2/5/2018 | Bearish | 29.38 | 8018 | MACD Cross-Down Signal |

| ZTS | Zoetis Inc. | 2/5/2018 | Bearish | 79.9 | 7497 | MACD Cross-Down ZeroLine |

| BSX | Boston Scientific Corporation | 2/5/2018 | Bearish | 29.27 | 7368 | MACD Cross-Down Signal |

| YUM | Yum! Brands, Inc. | 2/5/2018 | Bearish | 80.2 | 6577 | MACD Cross-Down ZeroLine |

| USB | U.S. Bancorp | 2/5/2018 | Bearish | 49.86 | 6131 | MACD Cross-Down Signal |

| WMT | Wal-Mart Stores, Inc. | 2/5/2018 | Bearish | 86.34 | 6083 | MACD Cross-Down ZeroLine |

| CVX | Chevron Corporation | 2/5/2018 | Bearish | 125.49 | 5909 | MACD Cross-Down Signal |

| TCP | TC PipeLines, LP | 2/5/2018 | Bearish | 25.14 | 5895 | MACD Cross-Down Signal |

| GIS | General Mills, Inc. | 2/5/2018 | Bearish | 42.49 | 5544 | MACD Cross-Down Signal |

| WBA | Walgreens Boots Alliance, Inc. | 2/5/2018 | Bearish | 63.65 | 5411 | MACD Cross-Down Signal |

| ALL | Allstate Corporation (The) | 2/5/2018 | Bearish | 94.06 | 4939 | MACD Cross-Down ZeroLine |

| EOG | EOG Resources, Inc. | 2/5/2018 | Bearish | 116.65 | 4780 | MACD Cross-Down Signal |

| TGT | Target Corporation | 2/5/2018 | Bearish | 71.45 | 4603 | MACD Cross-Down Signal |

| ABT | Abbott Laboratories | 2/5/2018 | Bearish | 57.85 | 4520 | MACD Cross-Down Signal |

| BK | Bank Of New York Mellon Corporation (The) | 2/5/2018 | Bearish | 53.99 | 4480 | MACD Cross-Down Signal |

| MCD | McDonald’s Corporation | 2/5/2018 | Bearish | 160.68 | 4318 | MACD-H -ve Divergence |

| AMGN | Amgen Inc. | 2/5/2018 | Bearish | 169.43 | 4086 | MACD Cross-Down Signal |

| BHGE | Baker Hughes, a GE company | 2/5/2018 | Bearish | 35.6 | 3925 | MACD Cross-Down Signal |

| PEG | Public Service Enterprise Group Incorporated | 2/5/2018 | Bearish | 51.46 | 3543 | MACD -ve Divergence |

| UNH | UnitedHealth Group Incorporated | 2/5/2018 | Bearish | 233.46 | 3543 | MACD Cross-Down Signal |

| CAG | ConAgra Brands, Inc. | 2/5/2018 | Bearish | 35.94 | 3487 | MACD Cross-Down ZeroLine |

| BA | Boeing Company (The) | 2/5/2018 | Bearish | 324.19 | 3436 | MACD Cross-Down ZeroLine |

| DHI | D.R. Horton, Inc. | 2/5/2018 | Bearish | 43.61 | 3395 | MACD Cross-Down ZeroLine |

| ESRX | Express Scripts Holding Company | 2/5/2018 | Bearish | 74.05 | 3384 | MACD Cross-Down Signal |

| PRU | Prudential Financial, Inc. | 2/5/2018 | Bearish | 101.23 | 3229 | MACD Cross-Down Signal |

| NCLH | Norwegian Cruise Line Holdings Ltd. | 2/5/2018 | Bearish | 52.03 | 3130 | MACD Cross-Down ZeroLine |

| VRSK | Verisk Analytics, Inc. | 2/5/2018 | Bearish | 100 | 3128 | MACD Cross-Down ZeroLine |

| TJX | TJX Companies, Inc. (The) | 2/5/2018 | Bearish | 83.53 | 3115 | MACD Cross-Down Signal |

| LNC | Lincoln National Corporation | 2/5/2018 | Bearish | 67.72 | 3082 | MACD Cross-Down Signal |

| NUVA | NuVasive, Inc. | 2/5/2018 | Bearish | 48.15 | 3056 | MACD Cross-Down ZeroLine |

Have fun! Reader must understand what MACD is all about before using the results.

Moses US Stock Scan

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.