Thanksgiving special, the trading day after the American Thanks Giving day November 25, is an important trading day to watch. Usually, a good result of the retails market on Black Friday buying feast will show colours on the following trading day. The sales were higher than the expected on last Friday. All the US indices were followed and bullish at last. Dow Jones Index, DJI was up 291.23 point, S&P500 was up 33.88 points, and NASDAQ was up 85.83 points. This is really a thanksgiving special to many. Can this continue to Christmas?

Singapore Stocks Market benchmark, Straits Times Index was leading the way in showing 50.50 points up compare to last closed. This was broke away from the bears that followed for near two weeks. However, many are expecting it to go lower. Trade with caution.

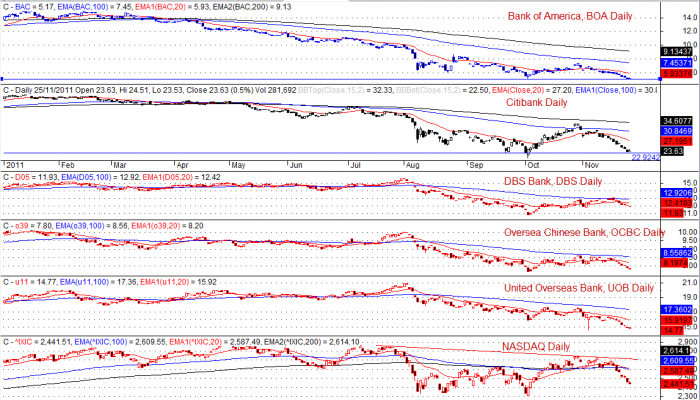

Today, let compare three major banks in Singapore, United Overseas Bank, UOB, DBS Bank, DBS, Oversea Chinese Banks, OCBC with Citibank and Bank of America (BOA). The chart shows all are bearish. US banks are facing with a lot of challenges after the collapse of Lehman Brothers in 2008. Singapore local banks are not having the issue. However, with the level of globalization, one may underestimate the effect. The recent case we see such as MF Global collapse is due to the Euro zone crisis.

This is a close-up view of the above chart.

There is no ways to study all the fundamental of a company, and read all the news. By the time you heard about the news, it is probably too late to react. However, the chart tells a story. It has various time frames, from tick, to a minute, 5 minutes, to months and years. The price bar shows the market emotion. The price bar taken in all the fundamental and the news that already knows to the market. Learn how to read the chart and verify with what you heard from the market and stay away from the dangerous zone. Trade what you see and not what you think. The worst what others think.

Disclaimer

The above sharing is the author view. It does not represent the site opinion. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks or indices of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software, the important on understand Technical Analysis. Example, it can insert a few prices and index such as NASDAQ, BOA and Citibank, banks from Singapore for analysis to make a future trading plan.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. Please get your advice from your professional financial consultant.