February 11, 2017

Moses Stock Trading Blog Site – AmiBrokerAcademy.com

Thank you for visiting the amibrokeracademy.com blog site. No one like us doing analysis like what you read here.

Welcome to Moses’s Stock Analysis @ AmiBrokerAcademy.com.

Trade what you see.

While we analyse the VIX for US market, we would also like to check how the rest of the market response to the big market. Let’s check the China Index.

^VIX Volatility Index

You can read the VIX analysis in this website here.

February 9, 2017 Volatility Index and Trendlines

China Shanghai SE Composite Index ^SSEC and Moving Average

If you will benchmark China market, such as SSE to US events such as job report, 2/23 and Intel Investment plan 2/9. You may see the market do not feel a threat in the Intel investment. in fact Intel has very little outsourcing activities as compare to many of the other tech companies. This is to keep the intellectual properties within than out of control. So, no surprising. The true is with the new plant added, can the market consume double or triple or finally ten fold increase when the plant is in full production. Do the market require that many Intel chips as compare to now, even with free PC given to third world countries. Just think. Think think (thing) got more things.

On the contrarian, with the double or triple of Intel chips you will need more other production facilities, are they (US) comping to build them within US. Is Lenovo ready to build plant in USA? Or Dell will recover and move their operation back to USA. Will see, may be in the next twelve months.

What is TA?

In TA, we do not read into all these information. We just see the movement of the price action and make trading decision. Trade what you see.

February 10, 2017 Shanghai Stock Exchange Composite Index and MA

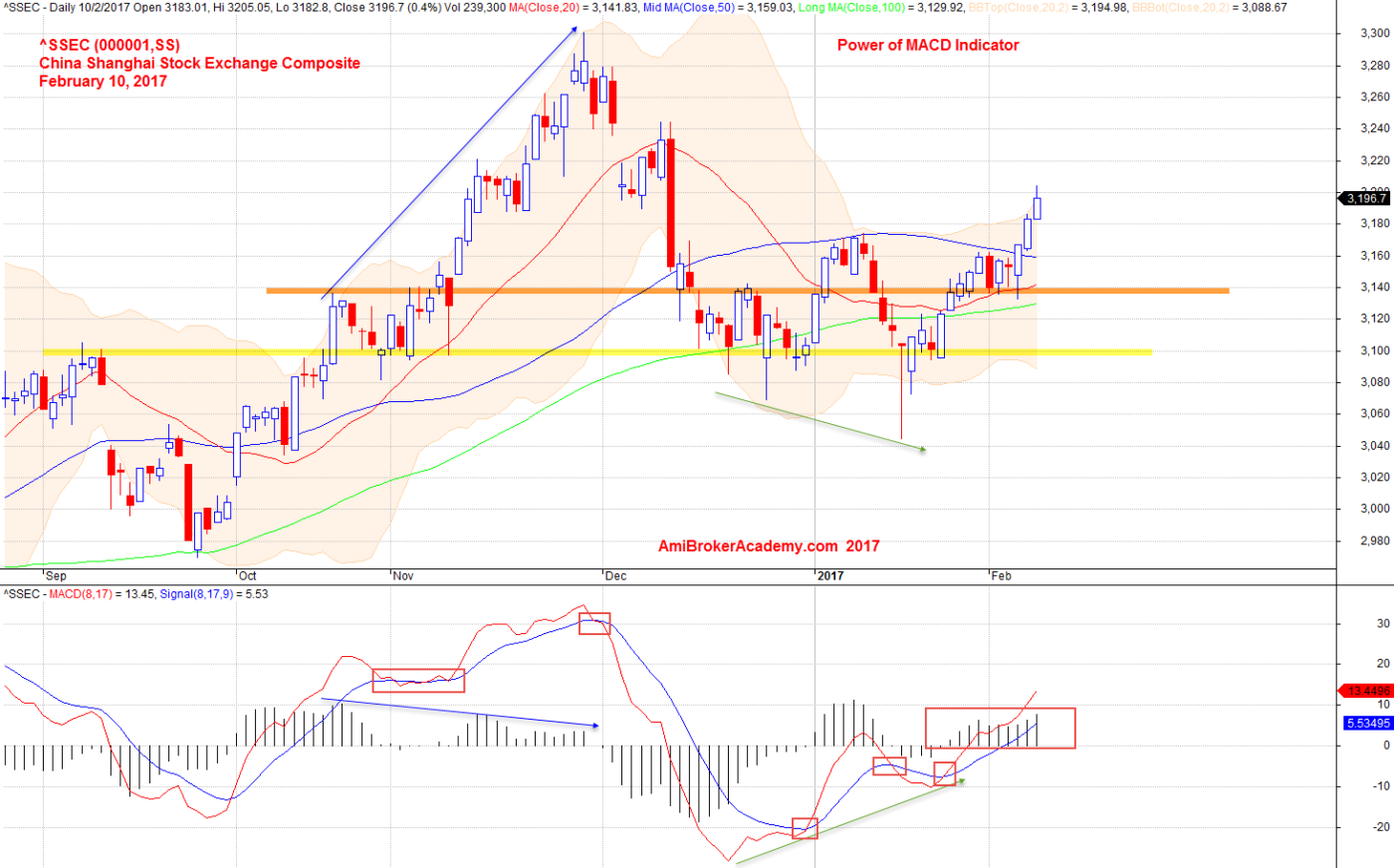

China SSE Composite Index ^SSEC and MACD Indicator

MACD is a great indicator, it is both leading as well as visual. From the information you know trend might be changing. Be ready for the change, in stead of jump in to buy higher and expect to sell higher. Or sell low and expect the market is going to go bottom.

February 10, 2017 China SSE Composite and MACD

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.