June 23, 2014

Technical Analysis on Asia Key Market on Great Recession of 2008 – 2009

Have we recovered from the Great Recession of 2008 – 2009, a major trigger from US sub-prime mortgage crisis? Let study a few key market in Asia, namely Japan, Hong Kong, South Korea and Singapore.

When look back, the 2008 – 2009 Great Recession has all starting with major incident in rescue of investment bank Bear Stearns in March 2008 and the failure of Lehman Brothers in September 2008. It is just like a domino phenomena as many of these institutions had invested in risky securities that lost much or all of their value when U.S. and European housing bubbles began to deflate during the 2007-2009 period.

Charts tell the thousand words. See the charts for details. It is self explanatory.

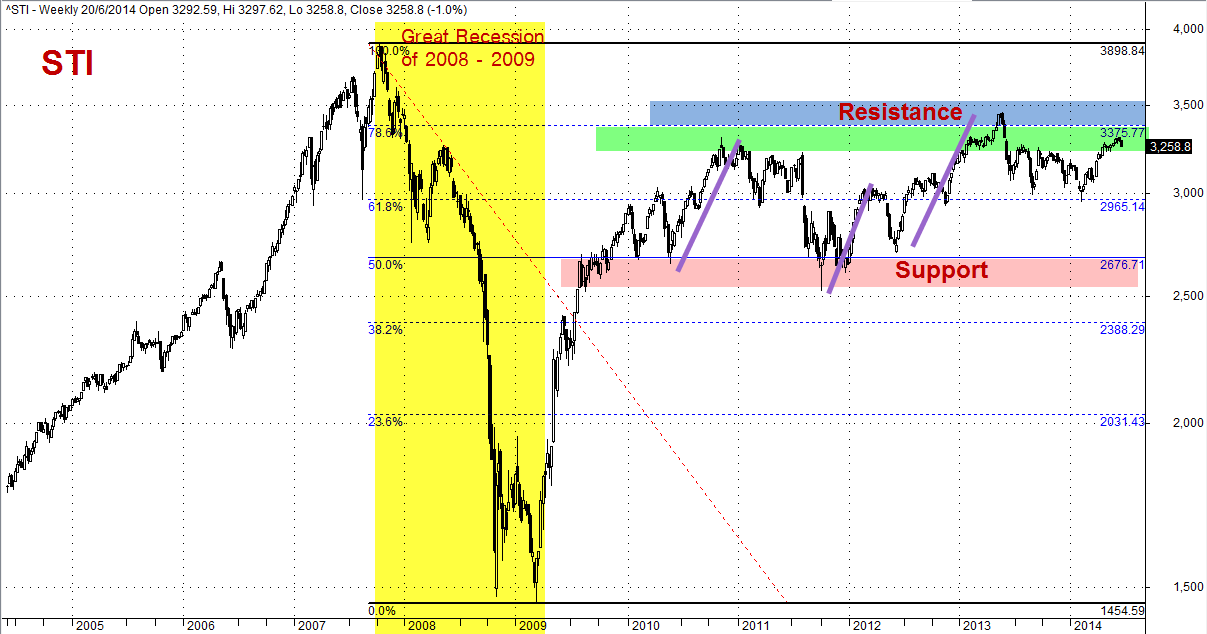

Straits Times Index, STI

.

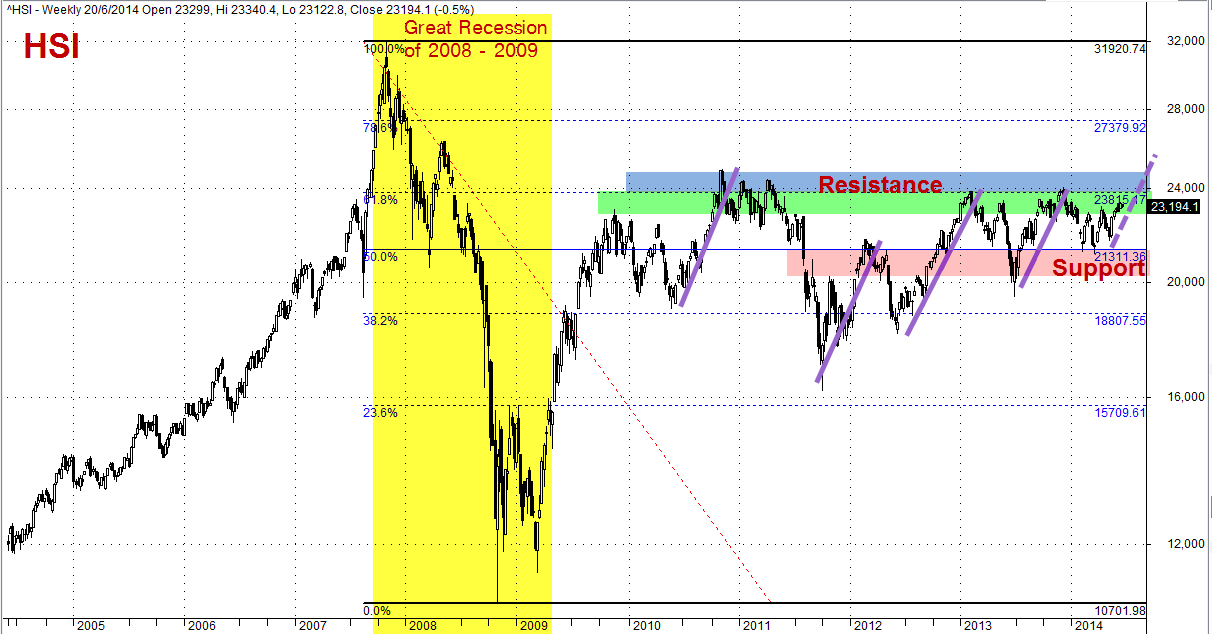

Hang Seng Index, HIS

Stock Benchmark, Hang Seng Index for Hong Kong Stock Market, HSI Weekly Chart and Great Recession 2008 – 2009

.

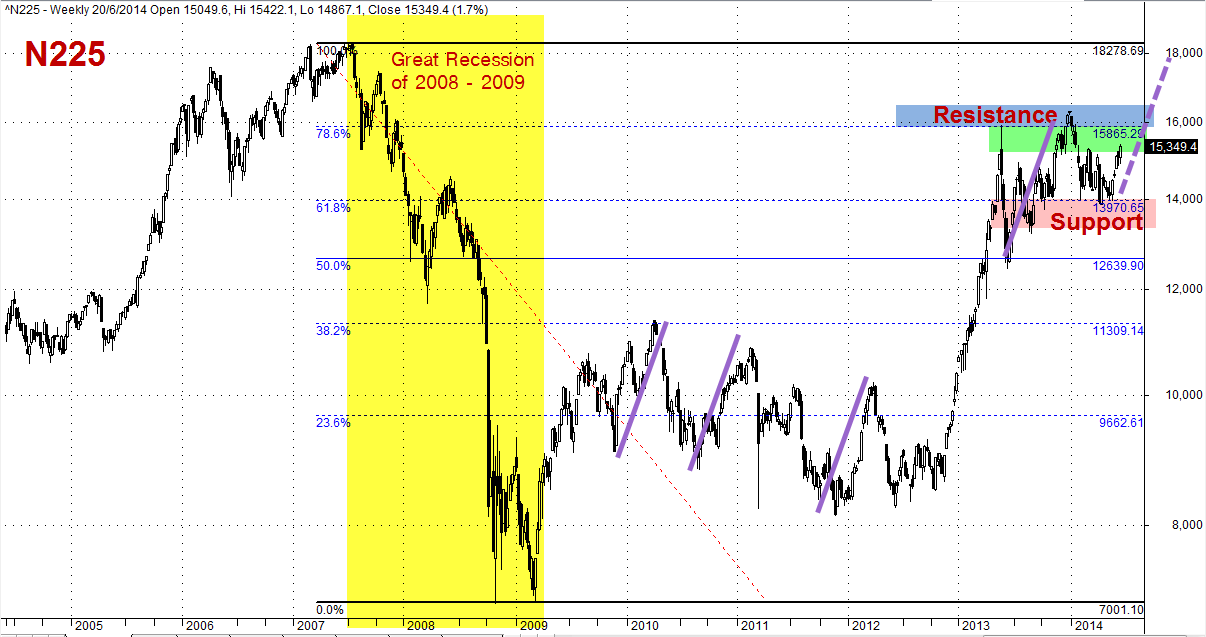

Nikkei 225, N225

.

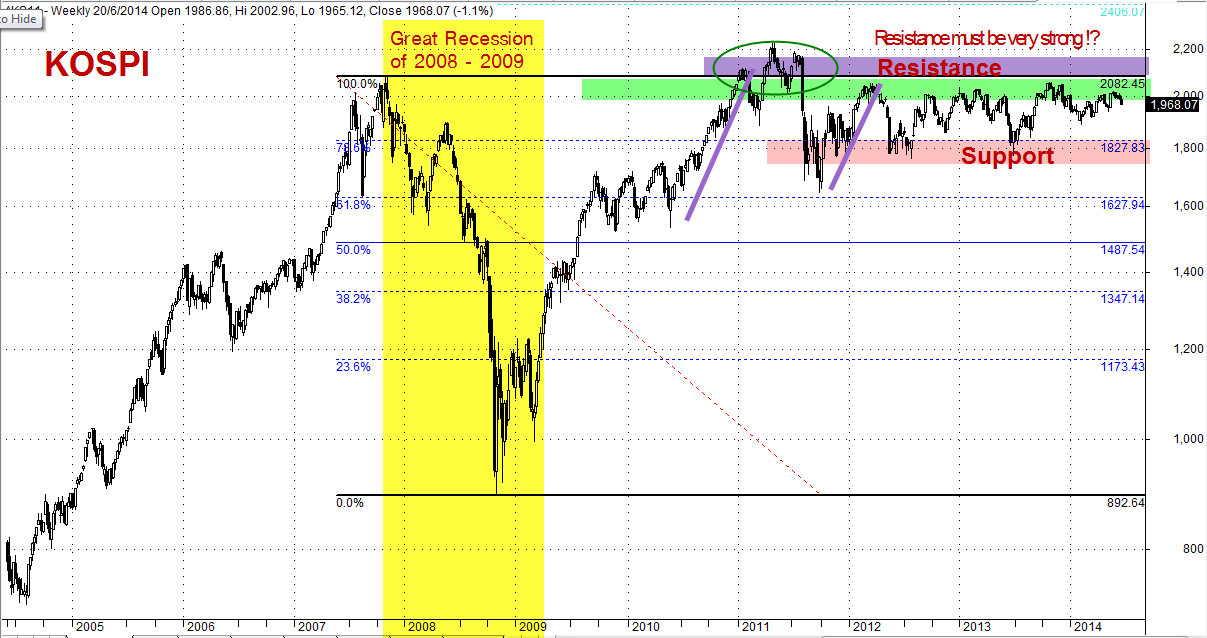

South Korea, KOSPI

South Korea seems to be the only market has recovered back to the level before 2008 – 2009 Great Recession. The market is repeating testing on the same level. However, the resistance seems strong.

.

Thanks for visiting the site, AmiBrokerAcademy.com.

Moses

DISCLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should not be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.