Welcome to AmiBrokerAcademy.com.

A Brief History

It is hard to believe that this website has been around since 2009. There was some years that no activities for the site. The site was originally setup try to help a friend to provide his trading courses. Send those interested to his company. Somehow, it did not work. However, the website did not stop then, otherwise the website will be gone after the first year.

The writing has changed overtime, however the MACD scan for Singapore stocks has not stop. From time to time, I would share some of the method I practice. One of my associate suggests that keep it simple. His point is very valid, your fantastic indicator may not be able to setup in your charting software. So, Support and Resistance, and moving averages will always be available does not matter how primitive the charting software is.

Besides provide he Singapore Stock MACD Scan Results, the sites also look at individual stock, from Singapore stock market, US stock market, and so on.

You visit is an encouragement to keep this site going. Thank your to the royal supporters, visit the website from time to time over the past years. Hope you have fun! Thank your to those new visitor, hope you and enjoy reading the material here.

AmiBroker Formula Language

The website provides free Singapore stock MACD indicator screener. The MACD indicator screener uses the AmiBroker powerful charting software’s AmiBroker Formula Language.

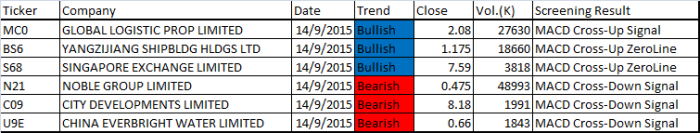

For September 14 Singapore Stocks MACD Scan Results

There is no MACD Scan Results for September 11, as it is Singapore Polling Day for GE 2015, General Election 2015.

MACD stands for Moving Average Convergence Divergence. The indicator is made up of 2 lines, MACD line and signal line.

In this post, we only provide a list of Singapore stocks that have MACD bullish or bearish signal base on the following. The list only for stocks that closed thirty five (35) cents or more and has 500,000 shares changed hands.

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

You Can Read More On this Site

You can read about other Singapore Stocks daily and weekly scan results in this website. The website provide chart analysis too.

Thanks for visiting the website.

Moses

DISCLAIMER

Website advice, “Stock trading is not a get rich quick scheme and it is high risk”.

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

The website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

THE CONTENTS HERE REFLECT THE AUTHOR’S VIEWS ACQUIRED THROUGH HIS EXPERIENCE ON THE TOPIC. THE AUTHOR OR WEBSITE DISCLAIMS ANY LOSS OR LIABILITY CAUSED BY THE UTILIZATION OF ANY INFORMATION PRESENTED HEREIN.

BESIDES THAT THE SOURCES MENTIONED HEREIN ARE ASSUMED TO BE RELIABLE AT THE TIME OF WRITING, THE AUTHOR AND WEBSITE ARE NOT RESPONSIBLE FOR THEIR ACCURACY AND ACTIVITIES.

THE CONTENT ONLY SHOULD BE CONSIDERED SOLELY FOR BASIC INFORMATION.

COPYRIGHT © 2015 Moses @ AmiBrokerAcademy.com. ALL RIGHTS RESERVED.

NO PART OF THE CONTENT MAY BE ALTERED, COPIED, OR DISTRIBUTED, WITHOUT PRIOR WRITTEN PERMISSION OF THE AUTHOR OR SITE.

ALL PRODUCT NAMES, LOGOS, AND TRADEMARKS ARE PROPERTY OF THEIR RESPECTIVE OWNERS WHO HAVE NOT NECESSARILY ENDORSED, SPONSORED, REVIEWED OR APPROVED THIS PUBLICATION.