The Second Increase in Interest Rates After 2009

^DJI Drifted South by 118 points

Read story on Bloomberg U.S. Stocks Slide After Fed Rate Hike as Energy, Utilities Drop.

The Dow Jones Industrial Average dropped 118.68 points to 19,792.53. US stocks slipped after Federal Reserved decided interest rates, as forecast a steeper path for borrowing cost increase next year.

2015 Approved A Quarter-point Increase

The Federal Open Market Committee, FOMC approved to raise rate in last December, read the story on CNBC, FED RAISES RATES BY 25 BASIS POINTS, FIRST SINCE 2006.

In 2008, Fed slashed rates to zero in the midst of the financial crisis and kept it there during the Great Recession and beyond.

A higher rates will also push up borrowing costs for households and companies

2016 Raise Rate by 0.25 After Two Days Meeting

Read story on The Wall Street Journal, Fed Raises Rates for First Time in 2016, Anticipates 3 Increases in 2017, and read story on CNN Money, Finally: Fed raises rates for first time in 2016.

Wednesday’s interest-rate increase, only the second since the central bank cut borrowing costs to near-zero in 2008.

The rate hike has widely expected for months.

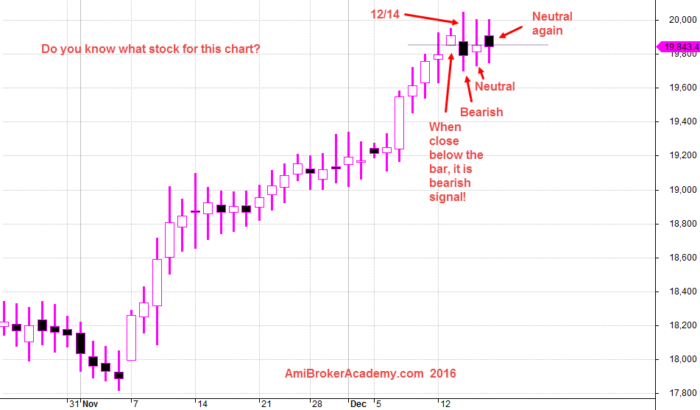

Can You Tell Which Index?

How do you trade when just reading the bar by bar? Look from right to left, find the last bull bar. If the next bar continue to go higher, bull. It is still bullish, can join the fun in buy high and sell higher. But, if the next bar close below. It indicates bearish. Check the next bar. In this case, the next few bars have neutralize the bearish. No trade at this point.

December 16, 2016 Do You Know Which Index?

Moses Stock Analysis

AmiBrokerAcademy.com

December 16, 2016

Disclaimer:

The discussion here is for educational purposes only. All information, data, symbols and trading ideas discussed hereby are the author or authors intend to demonstrate or illustrate purposes only. These are not recommendations or advice. It is not to be construed or intended as providing trading or legal advice.

Besides that this discussion is not an offer or solicitation of any kind in any jurisdiction where any AmiBrokerAcademy.com or its affiliate is try to do business.

Please note that active trading is not suitable for everyone. Any decisions you make about your trading or investment are important to you and your family, therefore should be made in consultation with a competent financial advisor or professional. We are not financial advisor and do not claim to be one.

Any views expressed here-in are not necessarily those held by amibrokeracademy.com.