June 14, 2014

A Misconception – Rally more buyers, Decline more sellers

We tend to say in a bullish market, there are more buyers than sellers. This is not true. Each trade transaction is made up of a buyer and a seller. Therefore, it is incorrect to say more buyers or more sellers. The right way to say is there are more traders willing to pay for a higher price or more traders willing to sell at the lower price.

Buyers bet for rally to make money, where sellers bet for decline to make money, greedy traders get slaughtered to satisfy their greed, and fearful traders follow guru and news fearfully.

Price Action represents a momentary consensus of value between two traders, a buyer and a seller. Price trend is a reflection of emotions of trader hopes, fears, optimism and greed. Price Action is a result of the trader expectation.

Price trend equal to trader expectations.

Welcome to Moses’ Stock Review and Free MACD Stock Screening.

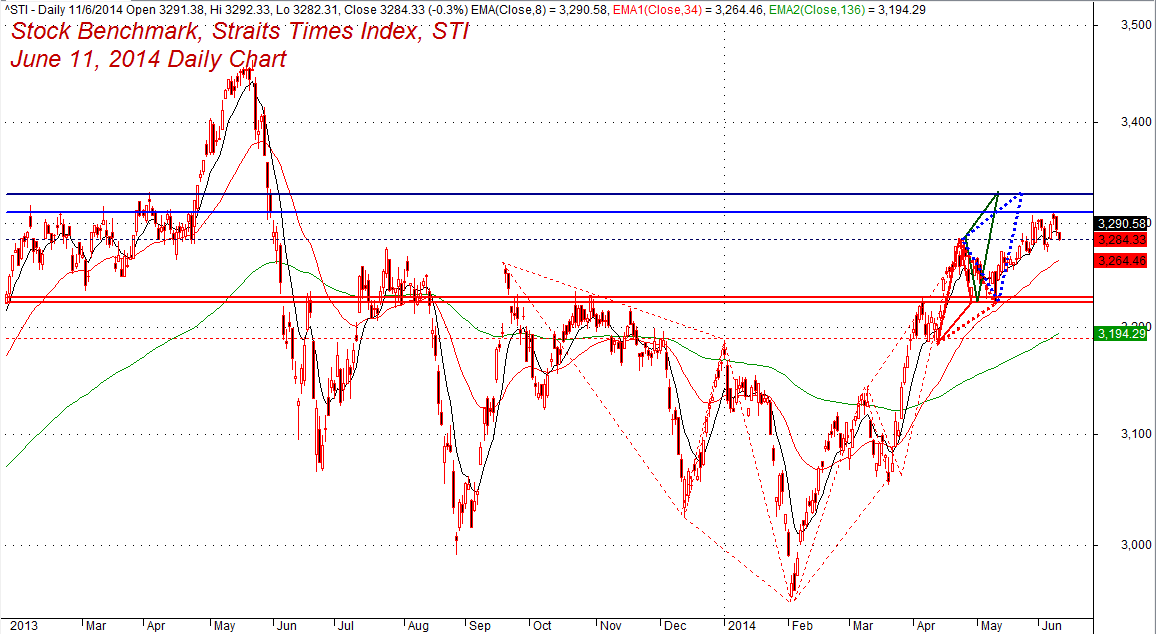

June 11, 2014 the market closed at 3290.04 points, STI down another 3.79 from the last closed at 3293.83 points. STI is respecting the resistance at 3310 points.

June 11, 2014 Straits Times Index, STI Daily Chart

.

June 11, 2014 Moses Free Stock MACD Screening Results

Free stock market scans results. Moses provides a list of Singapore stocks that have the following MACD signals.

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

- Volume traded greater 500,000 shares

June 11, 2014 Total 60 stocks have MACD bullish and bearish signals, 29 stocks are traded more than 500,000 shares.

| Ticker | Company | Signals | Close | Vol.(K) | Screening Result |

| 5GB | SIIC ENVIRONMENT HOLDINGS LTD. | Bullish | 0.154 | 9316 | MACD Cross-Up Signal |

| 526 | HG METAL MANUFACTURING LTD | Bullish | 0.085 | 1974 | MACD Cross-Up Signal |

| SV3U | SOILBUILD BUSINESS SPACE REIT | Bullish | 0.8 | 1765 | MACD Cross-Up Signal |

| O23 | OSIM INTERNATIONAL LTD | Bullish | 2.64 | 1517 | MACD-H +ve Divergence |

| 5IM | GMG GLOBAL LTD | Bullish | 0.088 | 1470 | MACD Cross-Up ZeroLine |

| 5FD | SWISSCO HOLDINGS LIMITED | Bullish | 0.405 | 1428 | MACD-H +ve Divergence |

| F9M | KENCANA AGRI LIMITED | Bullish | 0.245 | 1162 | MACD Cross-Up Signal |

| W81 | UNIVERSAL RESOURCE & SVCS LTD | Bullish | 0.082 | 900 | MACD Cross-Up ZeroLine |

| C09 | CITY DEVELOPMENTS LIMITED | Bullish | 10.4 | 850 | MACD Cross-Up Signal |

| 569 | VICPLAS INTERNATIONAL LTD | Bullish | 0.09 | 626 | MACD Cross-Up ZeroLine |

| N21 | NOBLE GROUP LIMITED | Bearish | 1.42 | 17096 | MACD Cross-Down Signal |

| Y92 | THAI BEVERAGE PUBLIC CO LTD | Bearish | 0.62 | 14153 | MACD Cross-Down Signal |

| 5ME | EZION HOLDINGS LIMITED | Bearish | 2.16 | 5564 | MACD Cross-Down Signal |

| S08 | SINGAPORE POST LIMITED | Bearish | 1.67 | 5178 | MACD Cross-Down Signal |

| G13 | GENTING SINGAPORE PLC | Bearish | 1.34 | 4760 | MACD Cross-Down Signal |

| 5G9 | TRITECH GROUP LIMITED | Bearish | 0.235 | 3704 | MACD-H -ve Divergence |

| C52 | COMFORTDELGRO CORPORATION LTD | Bearish | 2.46 | 3282 | MACD Cross-Down Signal |

| 5G1 | EUROSPORTS GLOBAL LIMITED | Bearish | 0.28 | 2092 | MACD Cross-Down Signal |

| S21 | GENTING HONG KONG LIMITED | Bearish | 0.39 | 1631 | MACD Cross-Down ZeroLine |

| U11 | UNITED OVERSEAS BANK LTD | Bearish | 22.55 | 1538 | MACD Cross-Down Signal |

| L03 | LIAN BENG GROUP LTD | Bearish | 0.69 | 1519 | MACD Cross-Down ZeroLine |

| C06 | CSC HOLDINGS LTD. | Bearish | 0.081 | 1396 | MACD Cross-Down Signal |

| MF5 | ANCHUN INTERNATIONAL HLDGS LTD | Bearish | 0.079 | 977 | MACD Cross-Down ZeroLine |

| P9J | GLOBAL PREMIUM HOTELS LIMITED | Bearish | 0.325 | 930 | MACD Cross-Down Signal |

| SK6U | SPH REIT | Bearish | 1.02 | 879 | MACD Cross-Down Signal |

| E13 | ELLIPSIZ LTD | Bearish | 0.095 | 800 | MACD Cross-Down Signal |

| QS9 | GLOBAL INVACOM GROUP LIMITED | Bearish | 0.475 | 744 | MACD-H -ve Divergence |

| L19 | LUM CHANG HOLDINGS LIMITED | Bearish | 0.375 | 608 | MACD Cross-Down Signal |

| CY6U | ASCENDAS INDIA TRUST | Bearish | 0.795 | 587 | MACD -ve Divergence |

Thanks for visiting AmiBrokerAcademy.com.

Moses

DISCLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should not be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.