November 21, 2014

Has the Government measure impact the growth?

Singapore government has been trying to step into the property market since 2009 to slowdown the price. From a trader terminology, price action reversal. Where is the support? Anyone want to try to catch the falling knife, cat the bottom. How low is the low?

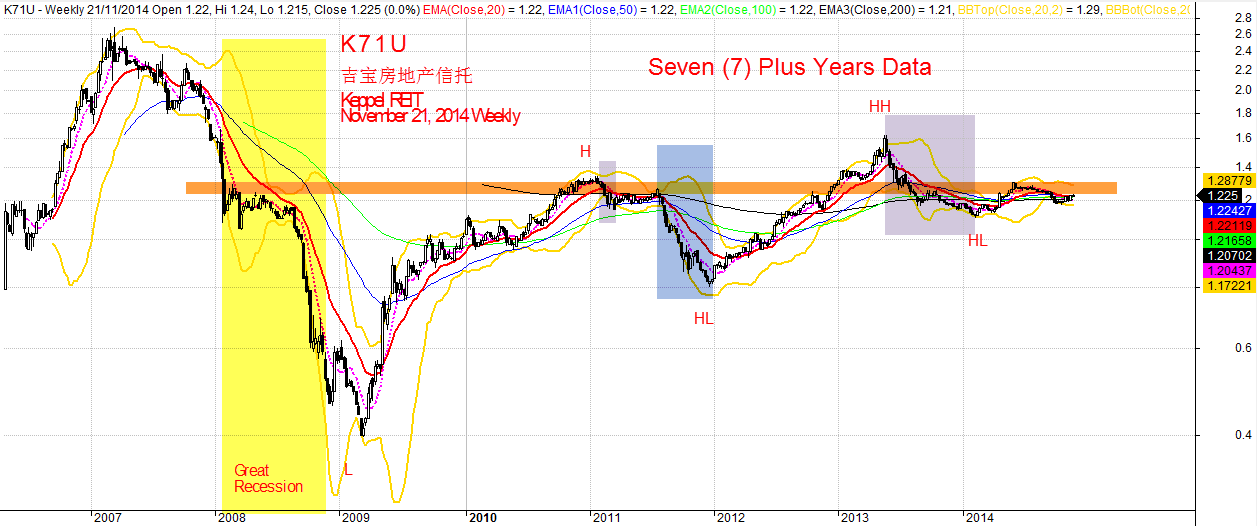

What has it impact to the Singapore property stocks. Chart tells a thousand words. Like examine a REIT stock, Keppel REIT. But take note, Keppel REIT is not just own property investment in Singapore, it has other porfolio.

REIT stands for Real Estate Investment Trust. The definition by Investopedia, a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate.

Keppel Reit, K71U

Who is Keppel REIT? Keppel REIT invests in a portfolio of commercial office and towers real estate and other real estate-related assets in Singapore and Australia.Keppel. REIT founded on November 2005 and headquarter in Singapore.

Let zoom out to understand how the company evolved in the last seven years.

Can the price action breakout from the zone?

Can we see the Singapore property market from the chart here? In the recovery mode? Will see.

References

1) Keppel Reit

2) Billionaire Enclave Prices Drop on Singapore Property Curbs

Moses

DISCLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice.

It has prepared without regard to any particular investment objectives, financial situation or needs.

Information should not be considered as an offer or enticement to buy, sell or trade.

Trading is risky. Trading is personal. Everything is relative, there is no right or wrong.

You should seek advice from your broker, or licensed investment adviser, before taking any action.

The website does not guarantee any results or investment return based on the information and instruction you have read here and assume.

It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own decision.

Also, any external links provide here are for easy reference. The opinions expressed by any of these links reference here are those of the authors and its site and do not necessarily reflect the positions of AmiBrokerAcademy.com.