March 23, 2018

Oscillator Moving Average Convergence Divergence

MACD is a popular trend following momentum indicator that shows the relationship of two moving averages of prices action; the MACD line and signal line.

Four MACD Signals:

- Crossovers – Sell Strategy, MACD crosses below the signal line. Buy Strategy, MACD rallies above the signal line. It is advisable to wait for confirmation to reduce possible whipsaw.

- Divergence – The security price action diverges from the MACD. It signals the end of the current trend.

- Cross Zero Line – MACD moves above or below zero line. Upward trend: Cross above zero line, short MA above long MA. Downward trend: Cross below zero line, short MA below long MA.

- Dramatic rise or fall – MACD rises or decline dramatically – when the shorter moving average pulls away from the longer-term moving average – Oversold or Overbought.

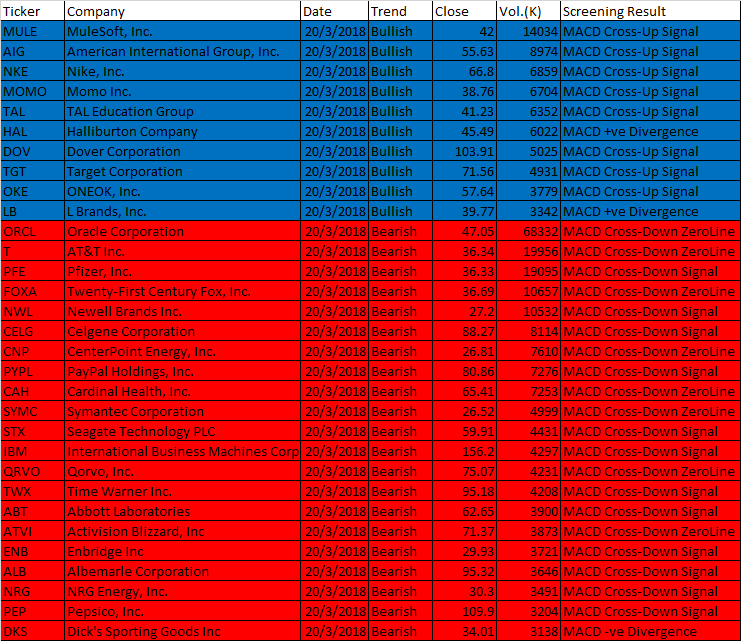

Free One-day US Stock MACD Screening Results for 20 March 2018

Remember all setup can fail. This is true for all indicators. It is also true for MACD signals setup. See some of the MACD setup fail examples on this website.

March 20, 2018 US Stock One-day MACD Signals

- MACD line crosses above MACD signal – Bullish trend

- MACD line crosses above zero line – Bullish trend

- MACD Histogram +ve Divergence – Bullish trend

- MACD line crosses below MACD signal – Bearish trend

- MACD line crosses below zero line – Bearish trend

- MACD Histogram -ve Divergence – Bearish trend

| Ticker | Company | Date | Trend | Close | Vol.(K) | Screening Result |

| MULE | MuleSoft, Inc. | 20/3/2018 | Bullish | 42 | 14034 | MACD Cross-Up Signal |

| AIG | American International Group, Inc. | 20/3/2018 | Bullish | 55.63 | 8974 | MACD Cross-Up Signal |

| NKE | Nike, Inc. | 20/3/2018 | Bullish | 66.8 | 6859 | MACD Cross-Up Signal |

| MOMO | Momo Inc. | 20/3/2018 | Bullish | 38.76 | 6704 | MACD Cross-Up Signal |

| TAL | TAL Education Group | 20/3/2018 | Bullish | 41.23 | 6352 | MACD Cross-Up Signal |

| HAL | Halliburton Company | 20/3/2018 | Bullish | 45.49 | 6022 | MACD +ve Divergence |

| DOV | Dover Corporation | 20/3/2018 | Bullish | 103.91 | 5025 | MACD Cross-Up Signal |

| TGT | Target Corporation | 20/3/2018 | Bullish | 71.56 | 4931 | MACD Cross-Up Signal |

| OKE | ONEOK, Inc. | 20/3/2018 | Bullish | 57.64 | 3779 | MACD Cross-Up Signal |

| LB | L Brands, Inc. | 20/3/2018 | Bullish | 39.77 | 3342 | MACD +ve Divergence |

| ORCL | Oracle Corporation | 20/3/2018 | Bearish | 47.05 | 68332 | MACD Cross-Down ZeroLine |

| T | AT&T Inc. | 20/3/2018 | Bearish | 36.34 | 19956 | MACD Cross-Down ZeroLine |

| PFE | Pfizer, Inc. | 20/3/2018 | Bearish | 36.33 | 19095 | MACD Cross-Down Signal |

| FOXA | Twenty-First Century Fox, Inc. | 20/3/2018 | Bearish | 36.69 | 10657 | MACD Cross-Down ZeroLine |

| NWL | Newell Brands Inc. | 20/3/2018 | Bearish | 27.2 | 10532 | MACD Cross-Down Signal |

| CELG | Celgene Corporation | 20/3/2018 | Bearish | 88.27 | 8114 | MACD Cross-Down Signal |

| CNP | CenterPoint Energy, Inc. | 20/3/2018 | Bearish | 26.81 | 7610 | MACD Cross-Down ZeroLine |

| PYPL | PayPal Holdings, Inc. | 20/3/2018 | Bearish | 80.86 | 7276 | MACD Cross-Down Signal |

| CAH | Cardinal Health, Inc. | 20/3/2018 | Bearish | 65.41 | 7253 | MACD Cross-Down ZeroLine |

| SYMC | Symantec Corporation | 20/3/2018 | Bearish | 26.52 | 4999 | MACD Cross-Down ZeroLine |

| STX | Seagate Technology PLC | 20/3/2018 | Bearish | 59.91 | 4431 | MACD Cross-Down Signal |

| IBM | International Business Machines Corporation | 20/3/2018 | Bearish | 156.2 | 4297 | MACD Cross-Down Signal |

| QRVO | Qorvo, Inc. | 20/3/2018 | Bearish | 75.07 | 4231 | MACD Cross-Down ZeroLine |

| TWX | Time Warner Inc. | 20/3/2018 | Bearish | 95.18 | 4208 | MACD Cross-Down Signal |

| ABT | Abbott Laboratories | 20/3/2018 | Bearish | 62.65 | 3900 | MACD Cross-Down Signal |

| ATVI | Activision Blizzard, Inc | 20/3/2018 | Bearish | 71.37 | 3873 | MACD Cross-Down ZeroLine |

| ENB | Enbridge Inc | 20/3/2018 | Bearish | 29.93 | 3721 | MACD Cross-Down Signal |

| ALB | Albemarle Corporation | 20/3/2018 | Bearish | 95.32 | 3646 | MACD Cross-Down Signal |

| NRG | NRG Energy, Inc. | 20/3/2018 | Bearish | 30.3 | 3491 | MACD Cross-Down Signal |

| PEP | Pepsico, Inc. | 20/3/2018 | Bearish | 109.9 | 3204 | MACD Cross-Down Signal |

| DKS | Dick’s Sporting Goods Inc | 20/3/2018 | Bearish | 34.01 | 3138 | MACD -ve Divergence |

Have fun!Users must understand what MACD is all about before using the results.

Moses US Stock Scan

AmiBroker Academy.com

Disclaimer:

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.