Chart patterns provide an opportunity for early entry. However remember all setup can fail. Be ready to cut lost when the trade turns against you. So, you have to trade with eyes open; trade what you see and not what you think.

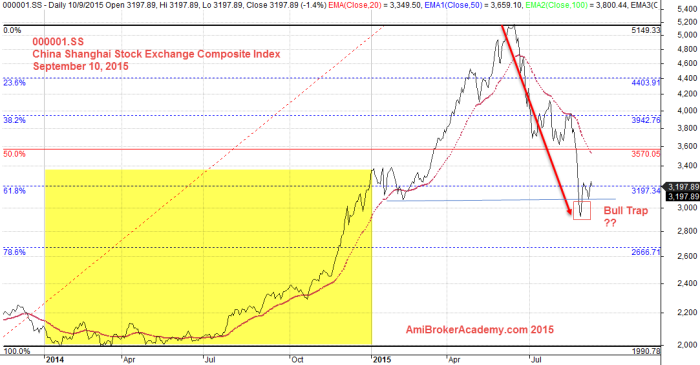

Picture worth a thousand words, see China Shanghai Stock Exchange Composite Index for illustration.

Bull Market Bear Market

Many neglected to realize and confused success with a bull market and was unprepared when the bear market (yet to confirm) finally came. The bear market will be confirmed when price action continue to form the lower high. Will see

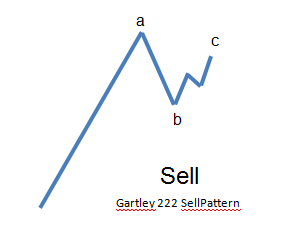

Gartley 222 Pattern

Larry Pesavento shared a pattern what he called “Gartley 222” pattern. He called this pattern as such because it was described on page 222 of the book Profits in the Stock Market written by H.M. Gartley back in 1935. This pattern is now used by many traders and was single handily popularized by Larry. Amazing!

Gartley Reversal Pattern, a study of top and bottom, such an opportunity does not arise everyday. But, but when it does it is a worthwhile waiting.

How to Trade?

- Patience to wait for the market formation to develop.

- Courage to put the order in and a protective stop to minimize risk.

China Stock Market Shanghai Stock Exchange Composite Index, 000001.SS

See our China SSE Composite Index chart posted earlier. The correction is a retracement of 61.8% at this point. What could you benefit from this retracement? Of course, there are risk, there are many many risk. There are so many intervention to prevent this correction by many, such as the authority.

However, technical analysis trade what the learning of TA. When you decide the swing low and swing high, the rest it just let the trade happen.

We must understand, in order for the price action to move up, it has to come down first (correction).

Look closely, you can easily spot the Gartley 222 Sell Pattern

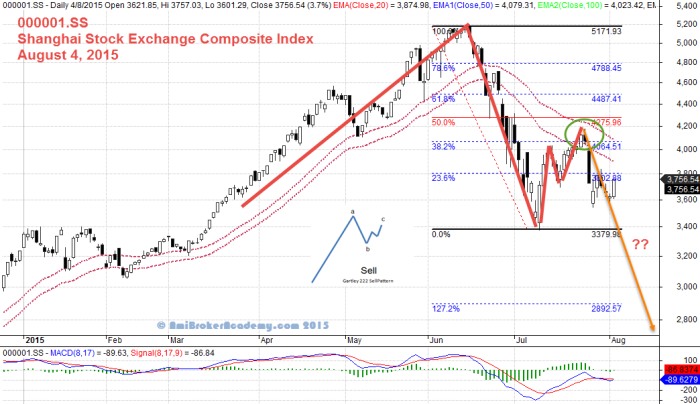

Look Back

In fact way back in August, our analysis has shared our view on where the China market index may move. See below.

Or more, from the link, Update Shanghai Stock Exchange Composite Index | 000001.SS | Moses’ China Stock Column

Moses

DISCLAIMER

Website advice, “Stock trading is not a get rich quick scheme and it is high risk”.

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

The website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

THE CONTENTS HERE REFLECT THE AUTHOR’S VIEWS ACQUIRED THROUGH HIS EXPERIENCE ON THE TOPIC. THE AUTHOR OR WEBSITE DISCLAIMS ANY LOSS OR LIABILITY CAUSED BY THE UTILIZATION OF ANY INFORMATION PRESENTED HEREIN.

BESIDES THAT THE SOURCES MENTIONED HEREIN ARE ASSUMED TO BE RELIABLE AT THE TIME OF WRITING, THE AUTHOR AND WEBSITE ARE NOT RESPONSIBLE FOR THEIR ACCURACY AND ACTIVITIES.

THE CONTENT ONLY SHOULD BE CONSIDERED SOLELY FOR BASIC INFORMATION.

COPYRIGHT © 2015 Moses @ AmiBrokerAcademy.com. ALL RIGHTS RESERVED.

NO PART OF THE CONTENT MAY BE ALTERED, COPIED, OR DISTRIBUTED, WITHOUT PRIOR WRITTEN PERMISSION OF THE AUTHOR OR SITE.

ALL PRODUCT NAMES, LOGOS, AND TRADEMARKS ARE PROPERTY OF THEIR RESPECTIVE OWNERS WHO HAVE NOT NECESSARILY ENDORSED, SPONSORED, REVIEWED OR APPROVED THIS PUBLICATION.