October 23, 2016

Batteries! Batteries! Batteries!

This has been in the mind of many people. Or if not the CXO concern for the past several months. Since the saga of the Galaxy Note 7, battery seem to be at the center stage.

Look around, there are so many of the devices depending on this invention, batteries. It is likely to be the key components for many of the devices, be it as small as phone, and as big as car. In fact, if you take a deeper look, many of the hearts are managed by the batteries too. If not the spaceship travelling to Mars.

So, question is do you want others to manage your key components. Think about it.

All in all, the whole industry has moved up another level. At least they will not underestimated a technology for decades. Next the company to watch will be the key components that manage the batteries. How much do you know them? A smartphone battery is managed by and IC, ie power chip. Google and read more about it. Have fun!

Read story, Note 7’s Death Leaves Samsung’s Brand at Risk by Bloomberg.

Lets look at an ins (trendy) technology, electric motor car.

TSLA Tesla Motors Inc and MACD Signals

There is a possible Gartley pattern, a double bottom. From the daily chart here. MACD is also signals a possible ending of trend. Stay tune. Have fun!

21 October 2016 Tesla Motors Inc Daily and MACD

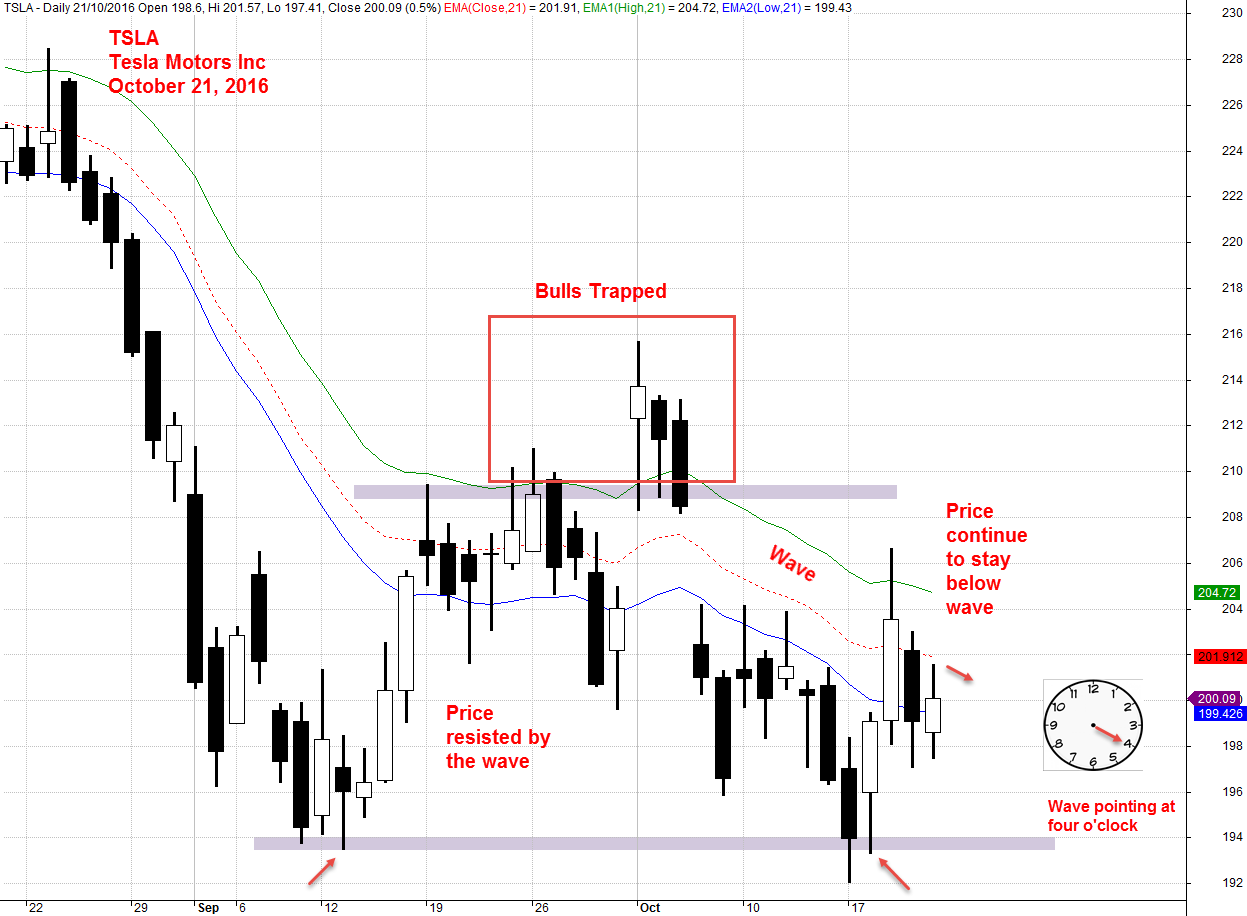

Tesla Motors Inc Daily TSLA and Wave

Wave is point at four o’clock.

21 October 2016, Tesla Motors Inc Daily and Wave

Lets See the bigger picture, Weekly Chart

Bigger Picture, TSLA Tesla Motors Inc Weekly and Wave

The Wave is point at Four o’clock.

October 21, 2016 Tesla Motors Inc Weekly and Wave

Quite often, we get many readers to ask so what is the conclusion. Buy or Sell!

The problem is looking at the weekly, bigger picture chart, we see there is a potential the price may cross back up the wave. But it may not be today, tomorrow. It may be quite some time before it crosses up. We begin to see the price stop at some level. If the price can not go any lower, the price will bounce and cross above Wave.

Trading is very personal, you may have the appetite to stomach it but not others. So trade within your ability, do not over stretch. See below another view, the price coming. If you do not have the power to buy and hold, just trade the smaller signals. Collect your profit as time comes. Stay alert.

TSLA Tesla Motors Inc Wave and ABCD

21October 2016 Tesla Motor Inc TSLA Weekly Wave and ABCD

Remember, the charts here are educational. So, we present you an analyst could have different views.

Have fun in reading the post here!

Moses US Stock Desk

AmiBrokerAcademy.com

Disclaimer: All information, data and material contained, presented, or provided on amibrokeracademy.com is for educational purposes only. It is not to be construed or intended as providing trading or legal advice. Decisions you make about your trading or investment are important to you and your family, therefore should be made in consultation with a competent financial advisor or professional. We are not financial advisor and do not claim to be. Any views expressed here-in are not necessarily those held by amibrokeracademy.com. You are responsible for your trade decision and wealth being.