Welcome to AmiBrokerAcademy.com.

This website uses powerful charting software AmiBroker for charting and indicators.

Investors Fear

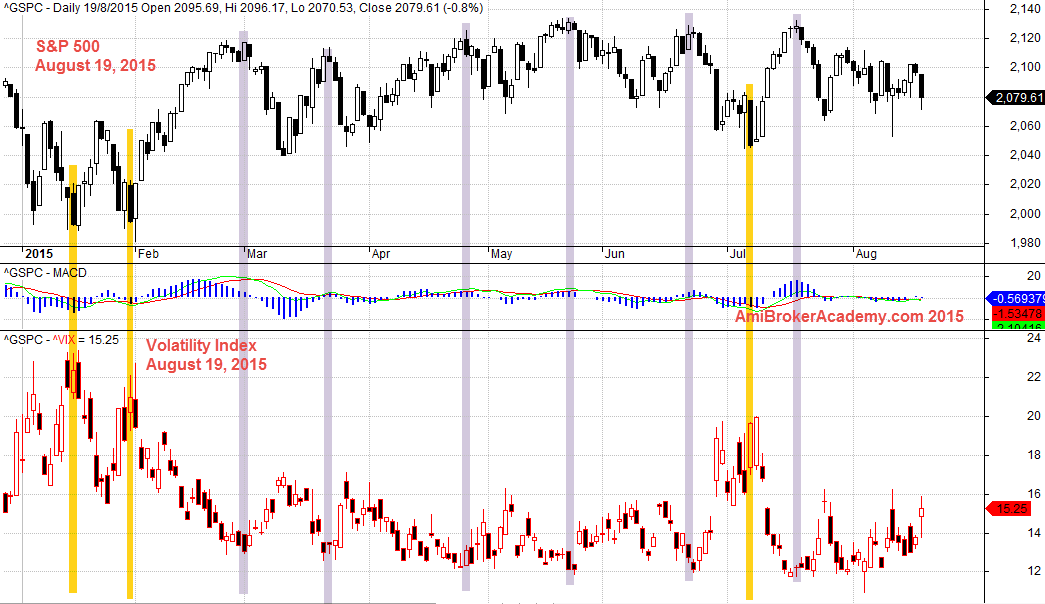

Besides taking profit, one other reason on sell off is fear, investors fear, traders fear, or market fear. In US stock market, VIX is a symbol for the Chicago Board Options Exchange (CBOE) in measuring volatility or market fear for options. In this case, this refer to a wide range of options on the S&P 500 Index.

Picture Worth a Thousand Words

Many of the answer are already in the additional lines and comments on the chart. See chart for more information.

CBOE VIX and Stock-Market

Although there are other factors, in most cases, a high VIX reflects increased investor fear and a low VIX suggests complacency. When VIX spikes high, traders in fear, the traders and investors panic and taking profits, while VIX decrease, the traders and investors relax and traders and investors hold their stocks. See the corresponding of the spikes between S&P 500 and VIX.

See chart for details.

Standard and Poor’s 500 and Volatility Index

The Market Fear

Now in Asia market, trust the China SSE Composite Index is like VIX for other markets. Why? When China SSE fears, fail to travel north, everyone follow.

Thanks for visiting the website.

Moses

DISCLAIMER

Website advice, “Stock trading is not a get rich quick scheme and it is high risk”.

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

The website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

THE CONTENTS HERE REFLECT THE AUTHOR’S VIEWS ACQUIRED THROUGH HIS EXPERIENCE ON THE TOPIC. THE AUTHOR OR WEBSITE DISCLAIMS ANY LOSS OR LIABILITY CAUSED BY THE UTILIZATION OF ANY INFORMATION PRESENTED HEREIN.

BESIDES THAT THE SOURCES MENTIONED HEREIN ARE ASSUMED TO BE RELIABLE AT THE TIME OF WRITING, THE AUTHOR AND WEBSITE ARE NOT RESPONSIBLE FOR THEIR ACCURACY AND ACTIVITIES.

THE CONTENT ONLY SHOULD BE CONSIDERED SOLELY FOR BASIC INFORMATION.

COPYRIGHT © 2015 Moses @ AmiBrokerAcademy.com. ALL RIGHTS RESERVED.

NO PART OF THE CONTENT MAY BE ALTERED, COPIED, OR DISTRIBUTED, WITHOUT PRIOR WRITTEN PERMISSION OF THE AUTHOR OR SITE.

ALL PRODUCT NAMES, LOGOS, AND TRADEMARKS ARE PROPERTY OF THEIR RESPECTIVE OWNERS WHO HAVE NOT NECESSARILY ENDORSED, SPONSORED, REVIEWED OR APPROVED THIS PUBLICATION.