January 8, 2017

Singapore Economy News

Singapore as A Key Hub for Port will Not Be Affected or Be Litter. Yes, it Depends …

“China’s ambitious plans to create a modern-day Silk Road by way of building roads and railways abroad are unlikely to change the face of global shipping, said industry observers. This means Singapore’s position as a key hub port, in turn, will be little affected as well. … “

Singapore, The Straits Times’ news article, New Silk Road’s impact on shipping will be limited will give you the insight why.

“… We (Singaporean) have also become complacent because of a collective hubris about our place in the world. …”, true or true?!

Singapore, The Straits Times’ news article, Hard decisions needed for Singapore to stay competitive will share the details.

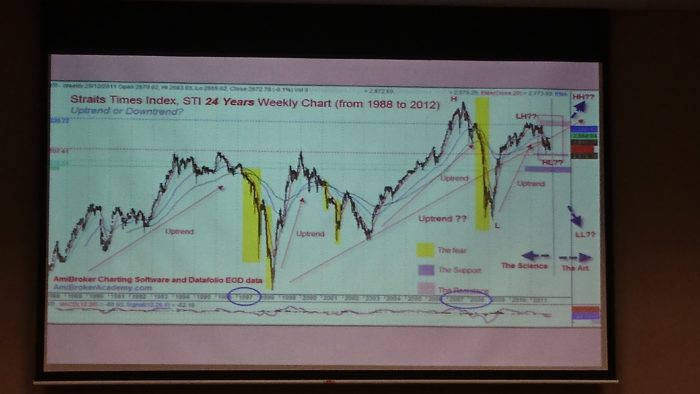

We have showed the chart that benchmark Singapore economy, The Straits Times Index, ^STI in end 2014, and end 2011 for 20 years and 24 years of data STI. Are we in the worst of all times? It depends how you read it, compare with what. Of course some years are bad, but all in all we are still up.

For your interest, you could read the old posting link here on What’s Next? Who Has the Crystal Ball That Can Read 2012 Stock Market? on The Straits Times Index 24 years data analysis see how we saw the stock trend and direction at that time. Remember, any reading into the future can only either right or wrong. … just read what we see and not what we think lah.

And do not miss another interesting posting, Think Things Got More Things! Straits Times Index was the other 20 years analysis.

For any market, there is only three ways or may be four; Up, down, sideways and the last and worst shutdown (close down the exchange for good).

Thank You Master Goh of IFB – 2017 Forecast

In fact I have to thank Master Goh of IFB. He includes one of my 24 years Straits Times Index chart he found in Google search in his presentation on his 2017 Forecast presentation this morning on what will be the stock market like in 2017. He is not reading the chart using technical analysis or fundamental. He is reading the stock market using the Fengshui Bazi approach and methodology. This is the number twelve years of annual event by Institute of Fengshui Bazi, IFB.

Every year just before the next Chinese New Year, the IFB will organize a talk for the public on Fengshui Bazi for the next year. This help everyone to be more confident into the next year.

I was sitting in as a paid audience to understand my 2017 forecast like. This is the Year of Fire Rooster. Attend the seminar to learn how to arrange my home, my workplace, plan my day and down to what to wear. If this sound interesting, google the Fengshui Bazi you probably will get educated better than I can explain here. In Singapore, one or two months before the Chinese New Year, many such seminar or workshop will organize by many of the Master and Guru here. Of course there are many of the Master and Guru from overseas too. Some come from Taiwan, Hong Kong, China, and Malaysia.

When Master Goh flash my chart, the first thing come across my mind was this sound familiar. The way the chart was coloured and lines were drawn. Hmm. Who are also having the same thought and understanding, hahaha. I took a snapshot, and when I enlarge it to see more details. I saw “amibrokeracademy.com” was printed on the chart. …

The slide of Master Goh’s presentation on the 2017 Forecast – the stock market.

Moses Stock Desk

AmiBrokerAcademy.com

Disclaimer:

The discussion here is for educational purposes only. All information, data, symbols and trading ideas discussed hereby are the author or authors intend to demonstrate or illustrate purposes only. These are not recommendations or advice. It is not to be construed or intended as providing trading or legal advice.

Besides that this discussion is not an offer or solicitation of any kind in any jurisdiction where any AmiBrokerAcademy.com or its affiliate is try to do business.

Please note that active trading is not suitable for everyone. Any decisions you make about your trading or investment are important to you and your family, therefore should be made in consultation with a competent financial advisor or professional. We are not financial advisor and do not claim to be one.

Any views expressed here-in are not necessarily those held by amibrokeracademy.com.