June 3, 2017

If You Google …

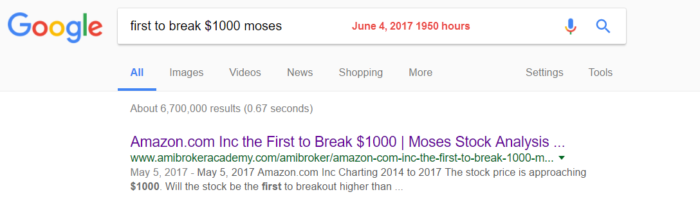

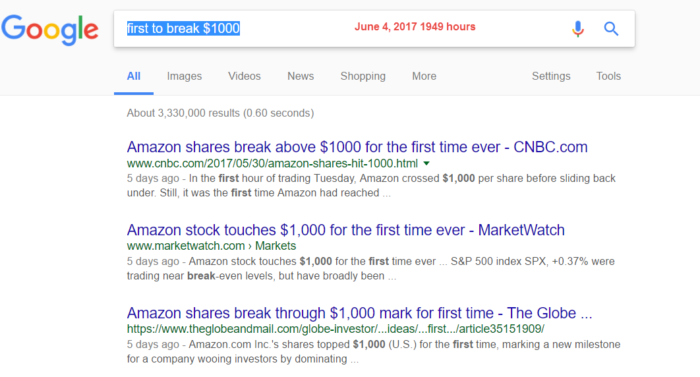

If you google ‘first to break $1000‘ as I did it in a moment ago, @SGT 1949 hours on June 4, you will probably find the following results.

CNBC.com Shared Five Dayas Ago Amazon Has Breakout One Thousand Dollars

June 4, 2017 First to Break $1000 – report the breakout

Picture Worth A Thousand Words – Amazon.com Charting

Five days ago, Amazon

June 2, 2017 Amazon.com Inc Breakout one Thousand Dollars Five Days May 30 Ago

In May 5, AmiBrokerAcademy.com already asking Amazon.com Inc may be the first to break $1000.

Using the search ‘first to break $1000 moses’, the following search results will tell you more on the breakout.

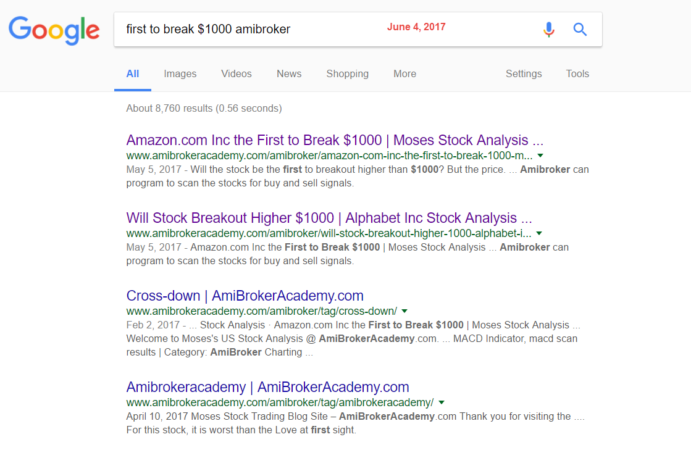

Using ‘first to break $1000 amibroker’ as key to search

This is the outcome. May 5, …

Maybe the key here is on May 5 in our analysis, our interest was which and when Amazon and Google can break the $1000. For traders who are prepared, they are now laughing to the bank. They may have all in for the stocks. One of the horse came in first now. Through powerful charting software like AmiBroker, we can do charting and analyse the stock with different indicator much quicker using sheets or layouts.

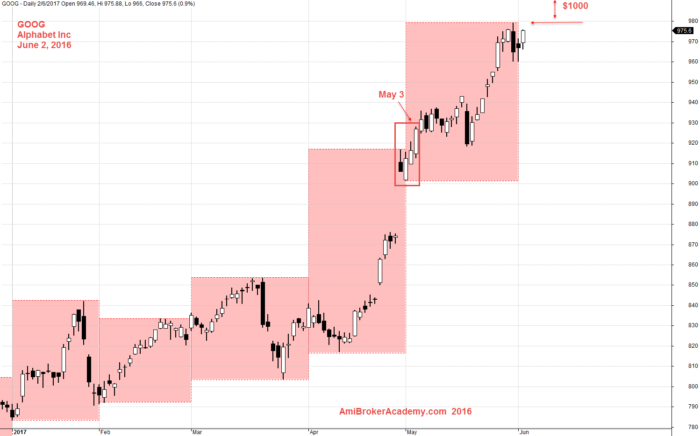

See the Google and Amazon chart for more.

Just a point to know, the illustration and tutorial is mainly for education and not for suggestion. Please be responsible for your own trade.

Amazon.com Inc Charting

Google Gap May be Weaken the Race

Many may worry of the covering the gap. See the many gaps earlier. But dashing cross the

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.