Which way the market is heading tomorrow? STI is Up or down? Does anyone know? For Chartist, the chart tells a story.

The volatility is here to stay and is probably going to increase. The market is ranging. The market has become choppy. One day the market bearish from Europe economy the next day the market rally because good economy number. For many months the media is focusing on the development in Europe. The latest development was two of the leaders in Europe have resigned. So, will this going to turn the market around. Will see.

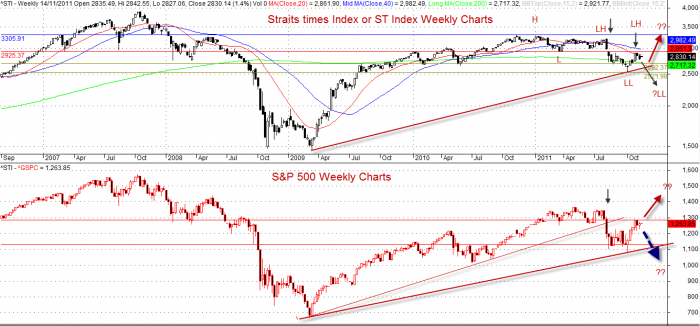

If you have followed the market, you would probably aware that STI has been climbing from the low at October 28, 2008 1666 and again climbing from the lowest at March 10, 2009 1485 to the peak at 3313 at November 11, 2010. Last week the STI closed at 2790.

Straits Times Index, or STI highly correlated to US market such as S&P 500. True? Many may agree that US market has great influence to all major markets in the world. Many reference the US market sentiment to trade, Is Singapore stocks market behaved the same? See the comparison of STI and S&P 500 chart for details.

Chart is showing 20 SMA is below 40 SMA, the index is also below 20 SMA. So the index will probably be resisted by 20 SMA first before it can break higher. However, the index is between 20 and 200 SMA. The index may get supported by 200 SMA and will not fall further. This may “ping-pong” for a while till the index can breakout of either 20 or 200 SMA.

So, once again which way the market is heading tomorrow? The true is “Don’t Know!” But the chart tells a story, if you know how to analyse it can provide you with a higher probability where the price action might go.

STI and SP500

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software. Example, it can insert another price such as S&P 500.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here.