October 18, 2014

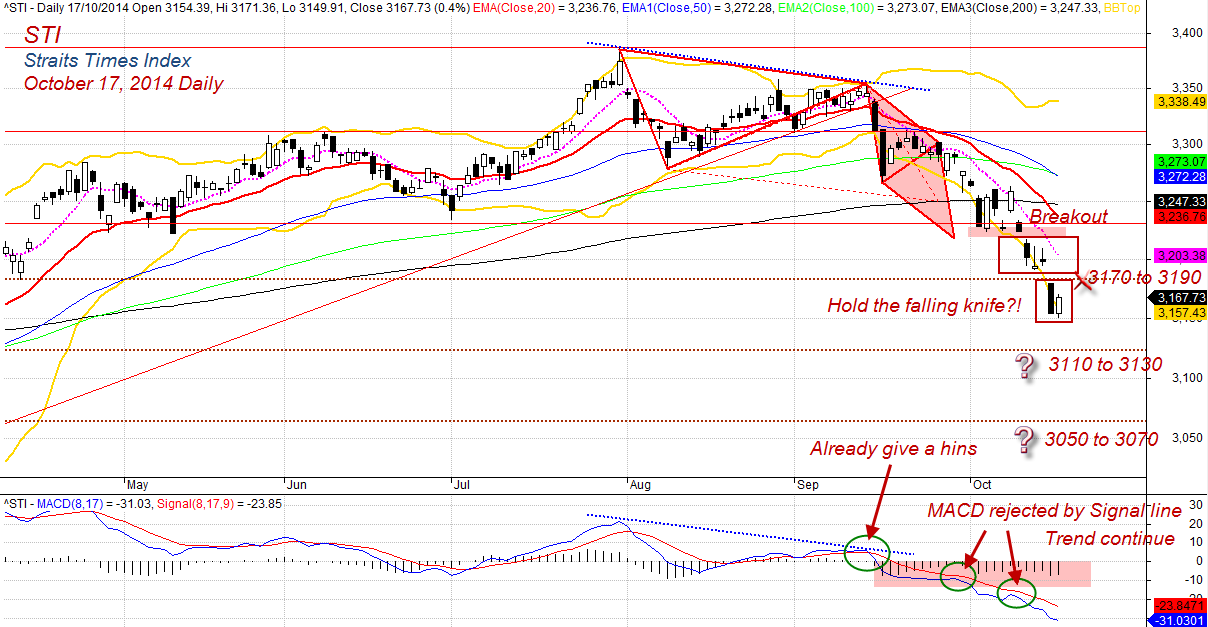

In the last analysis on the October 9, 2014 chart, we question can the 200 MA hold the falling price action (index). We also notice the price action closed inside the low band of the Bollinger Bands. However, the first candlestick reversal pattern, Engulfing failed. We see the second bullish attempt, abandoned baby bullish pattern. We will wondering can the reversal hold the falling knife. … However, Moving Average Convergence Divergence, MACD has indicated the bearish bias. Plus the MACD has rejected twice by the Signal Line; suggested the trend will continue; bearish trend.

Stock Market as Leading Indicator, we believe that stocks market lead the economy. Will the bull back just the usual zigzag movement or the start of the economy slow down or recession? If the believes of stocks market lead the economy then we should be careful now. As we always suggested, trade what you see and not what you think.

What is the true of the economy? We should be blamed for the problem. The property has been slow for the last two years. We has authority came and said, the price is not low enough. Can these guys reverse the situation now?

Picture (Chart) worth a thousand words.

Window to Singapore economy, Straits Times Index, STI Singapore Stocks benchmark.

Read other posting:

- What is the next likely level might hold the “falling knife” – ST Index

- Let the Profit Run! Straits Times Index

- Black Box!

Thanks for visiting the site, AmiBrokerAcademy.com.

Moses

DISCLAIMER

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

Trading is personal. You are responsible for your own trading decision.

The comment is the author personal experience. There is no intent for you to believe.