Welcome to AmiBrokerAcademy.com.

The website uses powerful charting software AmiBroker.

Look left and think right.

When you trade you must have good reason for your buy or sell. Especially in the current market condition, you definitely must find as many good reason as you can to support your trade decision and strategy.

Can China Lead the World Into Recession?

“… economists are now starting to mull whether China could lead the world into another recession” …

Read more on cnbc.com, Next: A China-led world recession?

… a months-long decline erased over $3 trillion worth of market value from the China country’s equity markets, …

Read more on foreignpolicy.com, Is China About to Plunge the World into Recession?

World May Be Heading into A Massive Recession

“Investors beware. The world may be heading into a massive recession led by China.

– Citigroup Chief Economist Willem Buiter said Wednesday.

Read more on cnbc.com, China situation spells global recession

Picture Worth a Thousand Words

Do not matter how all the guru speculate, the chart tells its all. See chart for more!

Why no one guru see this? My takes, non read and compare the charts.

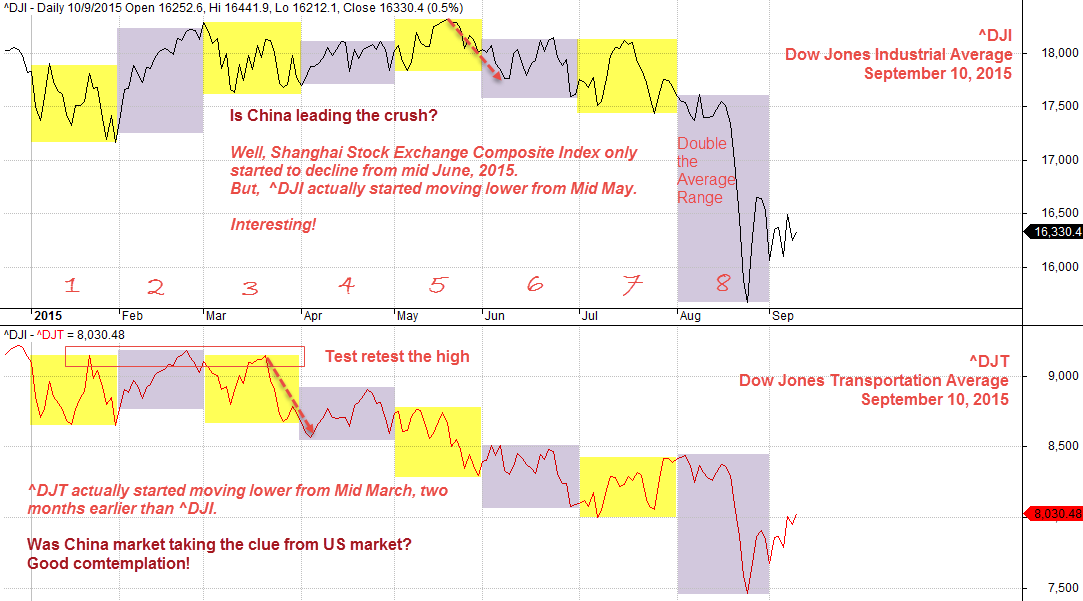

US Stocks Benchmark Dow Jones Industrial and Transporation Average

It is good to look at the chart for clue than hear the market gossip. True! True? See the Dow Jones Average for details.

If you recall our earlier analysis on China stock market, Shanghai Stock Exchange Composite Index the declined only started in mid June. However, from the chart you can see US market index, such as ^DJI and ^DJT, the declined started since mid May 2015 and mid March 2015.

So, while everyone worry that China is the one leading the world recession. Truly from the stock indexes chart. It should started by US market.

Of course, China is now have weighted in the world economy. But, the trigger bases on Dow Jones Averages, they have showed signs before China index.

Look Back

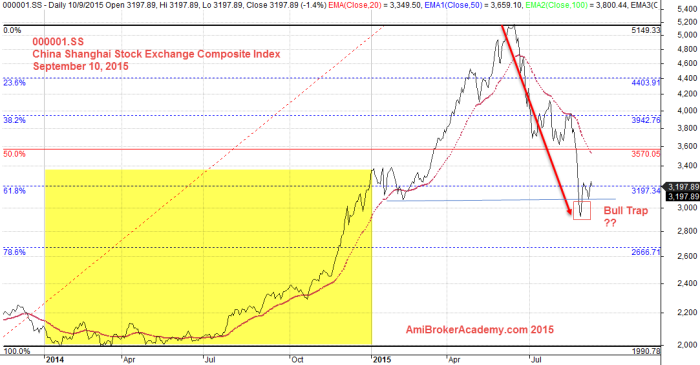

If you will look back,China only starts the roller coaster down from mid June 2015, the peak from 2014. Now, the price action has hit a low.

But if take beginning of 2015 as the level, the current low may be a bear trap. The price action is near 61.8% level. Be aware.

Thanks for visiting the website.

Moses

DISCLAIMER

Website advice, “Stock trading is not a get rich quick scheme and it is high risk”.

Information provided here is of the nature of a general comment only and no intend to be specific for trading advice. It has prepared without regard to any particular investment objectives, financial situation or needs. Information should NOT be considered as an offer or enticement to buy, sell or trade.

You should seek advice from your broker, or licensed investment advisor, before taking any action.

The website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids.

THE CONTENTS HERE REFLECT THE AUTHOR’S VIEWS ACQUIRED THROUGH HIS EXPERIENCE ON THE TOPIC. THE AUTHOR OR WEBSITE DISCLAIMS ANY LOSS OR LIABILITY CAUSED BY THE UTILIZATION OF ANY INFORMATION PRESENTED HEREIN.

BESIDES THAT THE SOURCES MENTIONED HEREIN ARE ASSUMED TO BE RELIABLE AT THE TIME OF WRITING, THE AUTHOR AND WEBSITE ARE NOT RESPONSIBLE FOR THEIR ACCURACY AND ACTIVITIES.

THE CONTENT ONLY SHOULD BE CONSIDERED SOLELY FOR BASIC INFORMATION.

COPYRIGHT © 2015 Moses @ AmiBrokerAcademy.com. ALL RIGHTS RESERVED.

NO PART OF THE CONTENT MAY BE ALTERED, COPIED, OR DISTRIBUTED, WITHOUT PRIOR WRITTEN PERMISSION OF THE AUTHOR OR SITE.

ALL PRODUCT NAMES, LOGOS, AND TRADEMARKS ARE PROPERTY OF THEIR RESPECTIVE OWNERS WHO HAVE NOT NECESSARILY ENDORSED, SPONSORED, REVIEWED OR APPROVED THIS PUBLICATION.