November 8, 2017

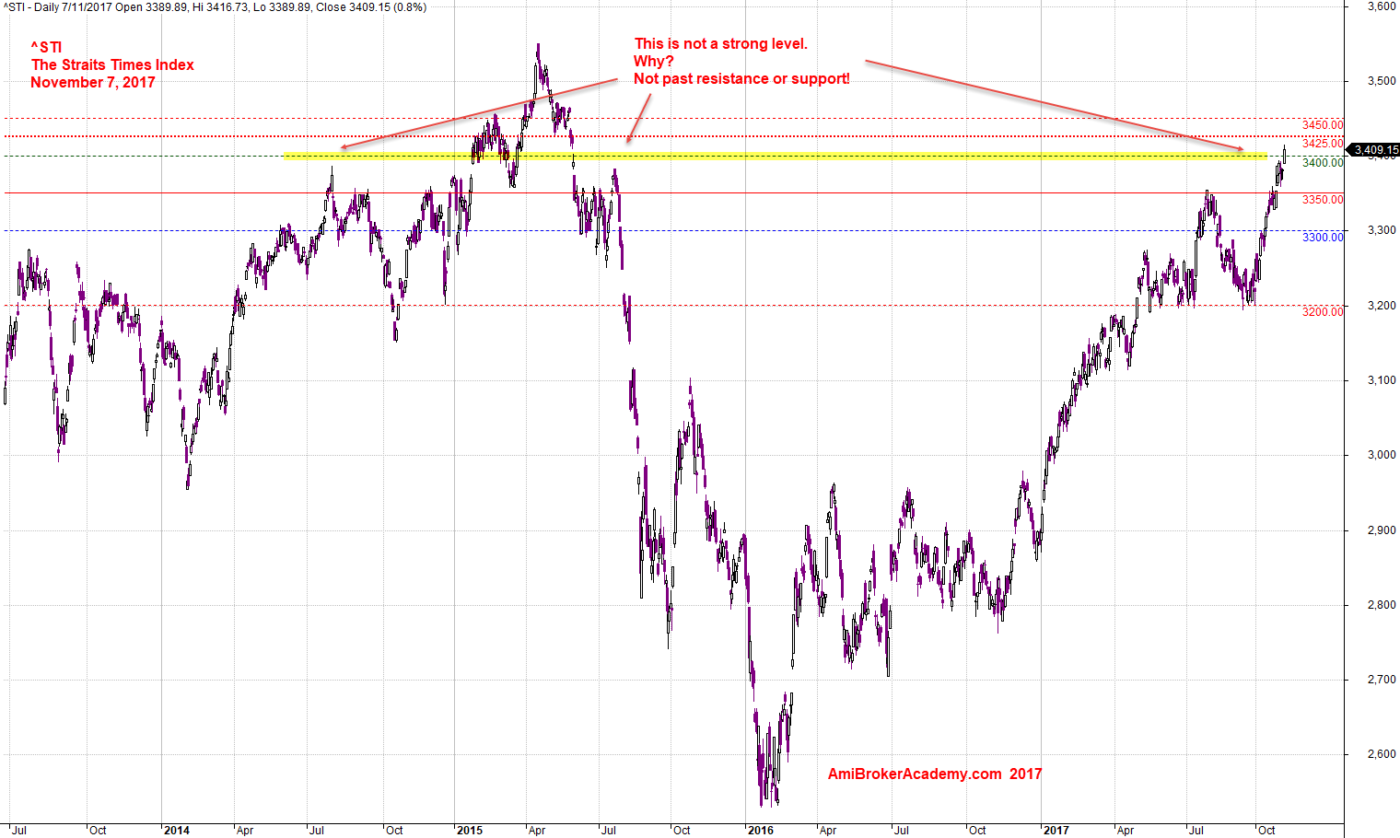

Significant Level – ST Index

To determine a level, such as support resistance to be significant, we see the market has memories of the level. How? For example, support becomes resistance, resistance becomes support, or resistance get resisted again and so on. So, is 3400 level a significant one, see chart. No think so. In other words, 3400 will be easily break. Watch it.

November 7, 2017 Straits Times Index and Significant Level

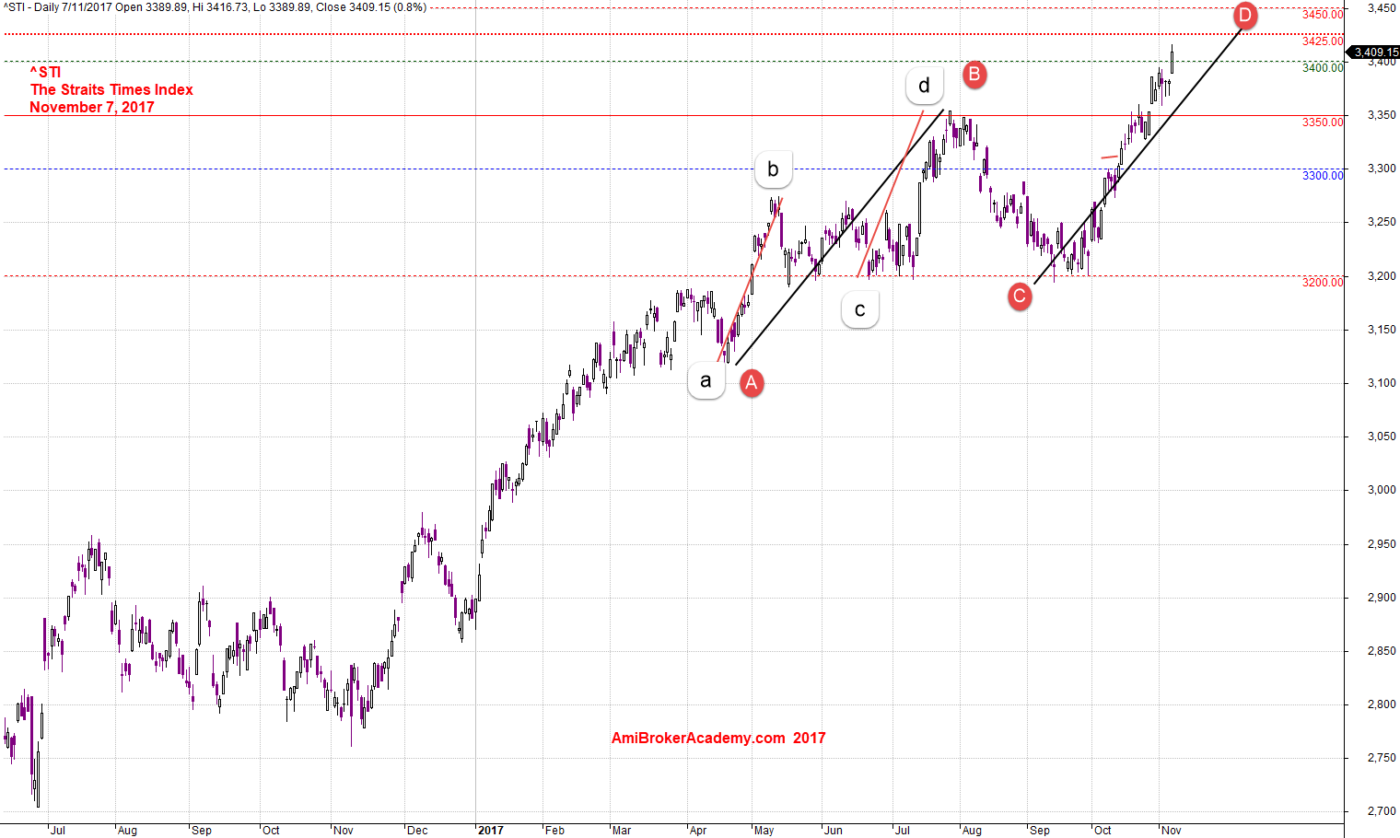

ST Index and Gartley ABCD Pattern

See chart for more, picture worth a thousand words.

November 7, 2017 Straits Times Index and ABCD Pattern

ST Index and Next ABCD Pattern

See chart for more, picture worth a thousand words.

November 7, 2017 Straits Times Index and Next ABCD Pattern

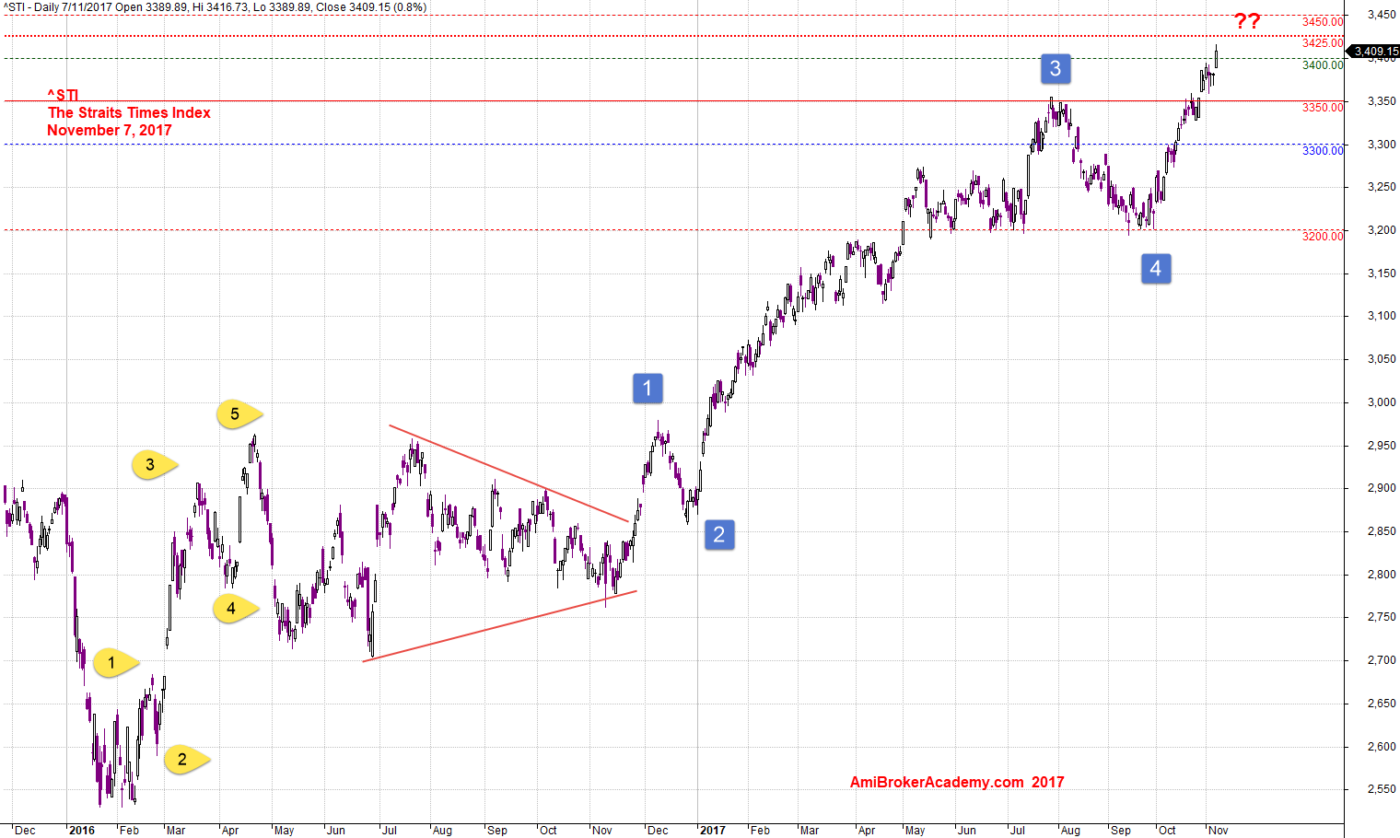

ST Index and Wave Count

See chart for more, picture worth a thousand words.

November 7, 2017 Straits Times Index and Wave Count

November 3, 2017 Stratist Times Index Weekly and Level

Everyone are very excited and obsessed the ST Index breakout higher than 3350 level, and 3400 level.

Market is Weak and No Confident – ST Index

When you are not able to read he chart better, turn to higher timeframe, such as weekly chart. The weekly chart shows that the week was engulfed in the previous week. There wasn’t any new breakthrough for the market. The market is weak and no confident.

Moses

AmiBrokerAcademy.com

Disclaimer

The above result is for illustration purpose. It is not meant to be used for buy or sell decision. We do not recommend any particular stocks. If particular stocks of such are mentioned, they are meant as demonstration of Amibroker as a powerful charting software and MACD. Amibroker can program to scan the stocks for buy and sell signals.

These are script generated signals. Not all scan results are shown here. The MACD signal should use with price action. Users must understand what MACD and price action are all about before using them. If necessary you should attend a course to learn more on Technical Analysis (TA) and Moving Average Convergence Divergence, MACD.

Once again, the website does not guarantee any results or investment return based on the information and instruction you have read here. It should be used as learning aids only and if you decide to trade real money, all trading decision should be your own.